This morning’s inflation report from the BLS showed a slight down tick in headline CPI to 3.6% YoY and a slight increase in core CPI to 2.1%. Energy was down 2% while gasoline fell 3.1%. Motor fuel prices have dominated the index in recent years as the US economy has remained weak. This explains much of the discrepancy in core and headline inflation. Unfortunately, crude oil is breaching the $102 mark as I type so the relief in prices is likely to be short lived. The price pinch from energy is becoming a growing concern and the persistent rise in energy prices should have all of us focusing more and more on theories regarding energy’s “endless bid”.

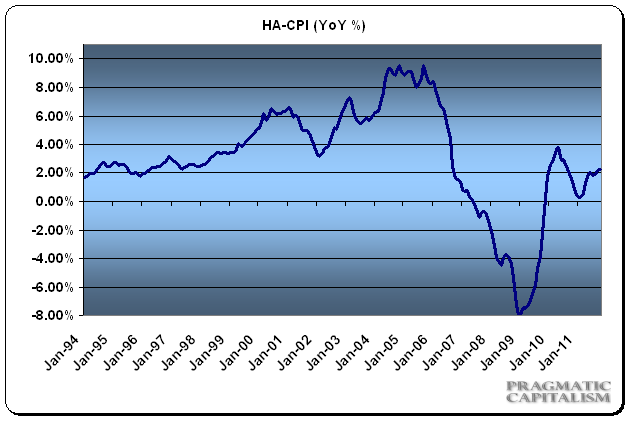

My HA-CPI (Housing Adjusted CPI) was up slightly from 2.14% to 2.26%. This is just about in-line with headline inflation and shows a moderate though not alarming level of inflation in the U.S. economy. The index includes a housing adjustment component that accounts for the change in housing values – a component that I believe is severely lacking in the government’s data (their housing component barely registered a decline over the course of the greatest US housing collapse of the last 80 years).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.