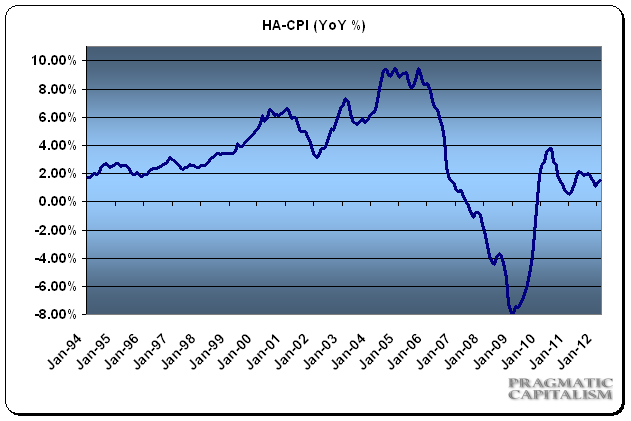

This morning’s inflation data showed no change in the rate of inflation at 2.9% year over year. Econoday has some good details on the report:

“In February, CPI inflation accelerated at the headline on higher energy costs. The core rate, however, eased. The consumer price index rose 0.4 percent, following a 0.2 percent gain in January. Market expectations for the headline number were for a 0.5 percent boost. Excluding food and energy, the CPI edged up 0.1 percent, following a 0.2 percent increase in January. Analysts projected a 0.2 percent rise.

Turning to major components, energy jumped a monthly 3.2 percent, following a 0.2 percent rise in January. Gasoline spiked 6.0 percent after a 0.9 percent increase the month before. Food price inflation posted at zero, following a 0.2 percent gain in January.

Within the core, indexes for shelter, new vehicles, medical care, and household furnishings and operations all advanced, while indexes for apparel, recreation, used cars and trucks, and tobacco all declined.

On an unadjusted year-ago basis, the headline number was up 2.9 percent in February, matching January’s pace. The core was up 2.2 percent versus 2.3 percent in January, not seasonally adjusted.”

My house price adjusted CPI was marginally higher on the month at 1.6%, but remains at very low levels. This is consistent with core inflation which is showing benign readings. I would expect inflation to pick up as the year goes on, the economy expands modestly and upside risk to energy prices remains into the summer months. This makes the probability of QE3 very low at the June meeting in my opinion.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.