This morning’s CPI report was kind of a snoozer with the headline rate coming in at 1.7% and the core rate coming in at 2.2%. The headline rate is unchanged from last month’s reading while the core rate is down slightly from 2.3%. Econoday has a summary of the component changes:

“By major components, energy fell 0.3 percent in July after declining 1.4 percent the month before. Gasoline actually rose 0.3 percent, following a 2.0 percent decrease in June. Declines were seen in electricity, piped gas, and heating oil. Food prices edged up 0.1 percent after gaining 0.2 percent in June.

For the core rise of 0.1 percent in July, this ended a streak of four consecutive 0.2 percent increases. Deceleration was largely due to declines in costs for airfare, used cars & trucks, new vehicles, and transportation services. Also, apparel and medical care inflation slowed.”

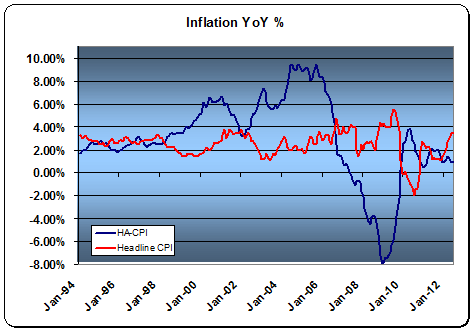

My housing adjusted CPI nudged down to a 0.77% year over year rate. Recent home price stability should begin to filter into this data in the coming months and could mean we’ve seen the bottom of the disinflationary trend that has occurred in recent months. The HA-CPI has led the BLS CPI by about 12 months which is not surprising given its housing weighting which tends to have a big impact on economic activity and prices in general. For now, this all appears pretty consistent with an economy that is just sliding by. And unfortunately, our leaders think they can’t do anything to help out the private sector because they’re worried we’re “running out of money” when the reality is that the USA has an inflation constraint (of which there is none to be concerned about currently) and not a solvency constraint.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.