Last week’s CPI report showed increasing signs of a disinflationary trend. After several months of fairly uncomfortable headline readings and a core rate that is bumping up against the top of the Fed’s 2% target, it finally appears as though the Fed’s much expected temporary inflation could be coming to fruition. Headline came in at 3.4% on a YoY basis while the core came in at 2.2%. The headline is down from a recent high of 3.8%.

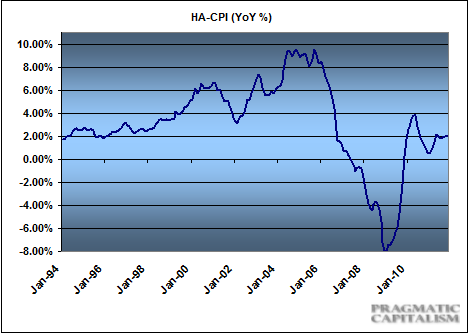

My Housing Adjusted CPI came in unchanged at 1.99% on a year over year basis. This is consistent with the core rate and continues to show very low levels of inflation:

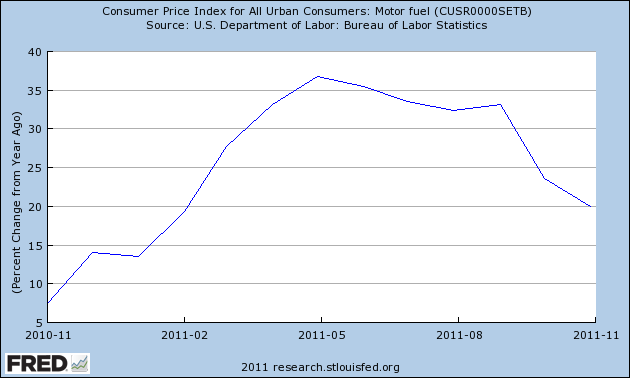

As I noted last week, the dominant driver in the CPI data has been motor fuel which has been on an absolute tear. And as commodity prices decline substantially and the year over year comps become increasingly difficult we’re likely to see the impact from motor fuel lessen as we move into 2012. The updated motor fuel data shows continuing declines in the YoY data and should continue to trend lower as we head into April which was the peak in the big spike from the mess in Libya last year. This should keep a lid on the rate of inflation and if another large spike in fuel does not materialize in 2012 it could become a significant sign of deflation.

This could just give the Fed its opening for further policy action next year, but we’ll be monitoring the situation closely. Fuel prices remain uncomfortably high heading into the new year, but anything close to last year’s surge certainly looks like an outside risk. At this point, I continue to think disinflation is the likely trend moving into Q1 2012.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.