Back in February I provided a broad inflation update wherein I stated that core inflation was likely to tick higher from 1.8% to 2.3%. The June CPI report showed a core inflation rate of…2.3%. That remains a very low historical rate, but it’s been on the move higher in the last year. So now that we’re at my target from the beginning of the year – where to from here?

Now, I know that forecasting is never a great idea. But it’s a necessary part of any good financial plan. And for me it helps me better understand the probable outcomes of future events so I can better handle asset market risks from a behavioral perspective. For instance, if I were seriously worried about hyperinflation and the empirical evidence pointed to a high likelihood of that risk I would be very uncomfortable owning bonds and they would create an outsized behavioral risk in my portfolio. Knowledge is power in investing mainly because better understandings result in better behavior.

Moving on…the secular trends that I highlighted in February are all firmly in place. In fact, I would argue that some of Trump’s policies make them (like labor class strength and inequality) more reinforcing. So the likelihood of a high rate of inflation is low because the macro trends are putting an extreme amount of downward pressure on that potential outcome. But this does not mean that inflation rates couldn’t “normalize” or mean revert back towards something higher than what we’ve become accustomed to in the last few years.

Broader Price Trends

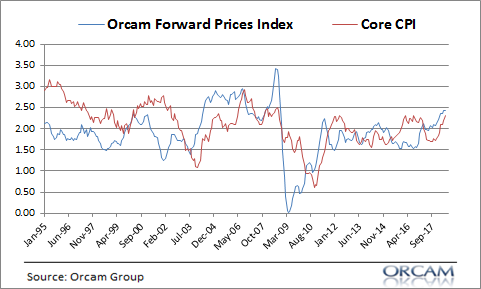

The Forward Prices Index has always been my preferred gauge of potential future inflation and it is currently consistent with core inflation of 2.4%. The rate of change here has moderated quite a bit which is consistent with the way the bond market has reacted to recent data – ie, not much.

So I expect prices to continue modestly higher, but not at a rate that is alarming or would cause me to become excessively fearful of a diversified portfolio of bonds. Weirdly, all of this is likely to lead the Fed to continue tightening into year-end which increases the odds of a yield curve inversion which could increase the risk of recession in 2020 (and hence, lower rates). Additionally, as equity markets remain highly valued and the gap between Core CPI and Forward Prices closes, the argument for holding bonds becomes that much more reasonable.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.