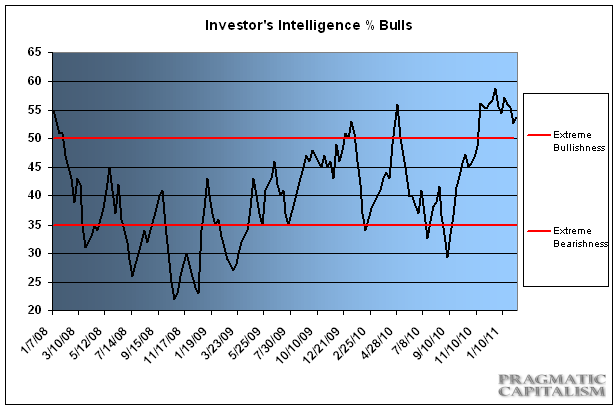

Bullish sentiment jumped to 53.7% from 52.7% according to the most recent Investor’s Intelligence survey. This is the 12th straight week in which the percentage of bullish investment advisors has exceeded the percentage of bears by more than 30%. The 10 week moving average in this differential is higher than it was at any point during 2007 when the market peaked.

We have seen similar persistent and excessive bullishness in the AAII survey. This optimism appears to have done nothing more than fuel the bullish uptick in the market. It is a sure sign that the Bernanke Put is well ingrained in every investor’s mind. If this is truly the case then one has to wonder if equities can fall while investors believe the Fed is there to support them at every dip? If not, then the trend line higher will remain intact into the Summer. So far, it has undoubtedly worked as every meager dip is met with ferocious buying. It’s become a can’t lose market. As I’ve been jokingly saying, buy dips with leveraged funds on leverage. And the fact that jokes like this are even being made is perhaps the most frightening thing currently occurring. Mr. Bernanke has rehashed the Greenspan bubble mentality. It is dangerous and irresponsible. But it is the world in which we live.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.