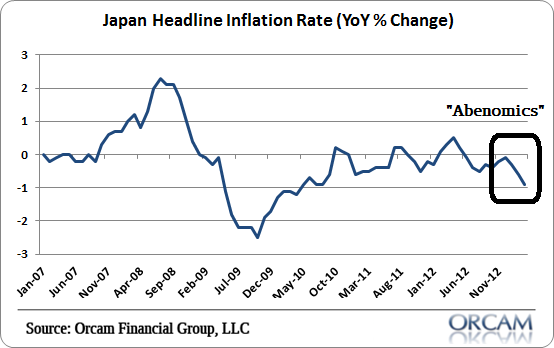

We’re getting deeper and deeper into the experiment now known as “Abenomics” in Japan. Ultimately, the plan is designed to defeat the decades of deflationary pressures in the Japanese economy. They’ve announced a massive fiscal plan, an official 2% inflation “target” a doubling of the BOJ’s balance sheet and as a result the Yen has declined 30% in a matter of months and the Japanese stock market has surged over 60%. By the looks of the market reaction you’d think that something had not just changed, but that we’d be looking at a new economy entirely.

But the latest CPI report shows that the deflation is actually WORSENING. The Statistics Bureau in Japan reported that Japan’s National Core CPI fell to -0.5% in march, down from -0.3%. This was worse than expectations of -0.4%. The headline rate fell to -0.9% versus expectations of -0.8%.

The latest reading is the worst reading since 2010. In fact, it’s the worst reading this year and down almost 1% from when the aggressive Japanese easing was first announced. In other words, if Abenomics is inflating prices it certainly isn’t working in the real economy and appears to only be “working” where gamblers are placing bets that it will eventually show itself….

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.