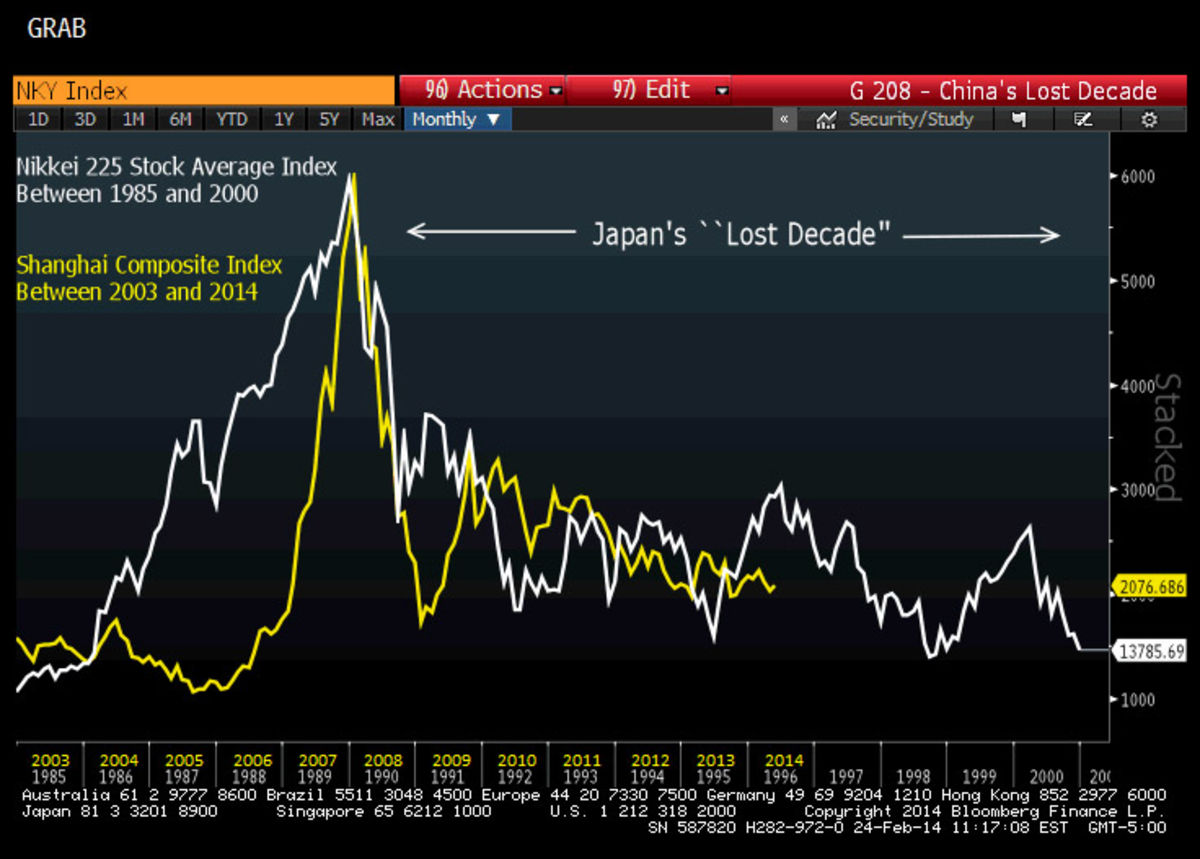

Remember the big boom in Chinese stocks a few years back? Chinese stocks were all the rage, new Chinese ETFs were cropping up and famous investors were pounding the table on the coming China boom. And then it all came crashing down. In a piece the other day, Bloomberg put this in perspective and asked if China was on the verge of its own Japanese style “lost decade”:

“The CHART OF THE DAY shows the Shanghai Composite Index is repeating a pattern in the Nikkei 225 Stock Average during the 1980s and 1990s. The Japanese gauge tumbled as much as 80 percent from its 1989 peak as a collapse in home prices hobbled the nation’s financial system and led to a decade of tepid economic growth. The Shanghai index has dropped 60 percent since the end of 2007, erasing almost $2 trillion of market value.

China’s lending surge over the past five years has evoked comparisons to the debt growth in Japan before its lost decade. Credit in the biggest emerging economy rose to 187 percent of gross domestic product in 2012 from 105 percent in 2000, compared with Japan’s increase to 176 percent in 1990 from 127 percent in 1980, according to JPMorgan Chase & Co.”

My view on China is pretty simple. It’s a black box. We don’t even know if the data coming out is correct. There have been reports of widespread corruption, malfeasance and other signs that make me less than comfortable about investing in China. I have no idea if China is on the verge of its own lost decade, but if you need some emerging market beta in your portfolio there’s really just no need to get it here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.