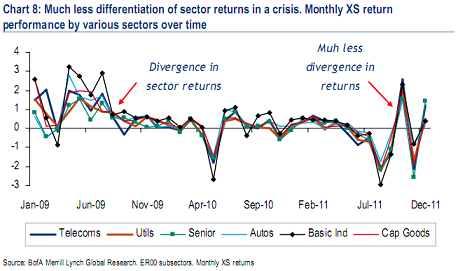

B of A had a good note out yesterday discussing the increasingly correlated market and sectors specifically (via Bank of America):

We don’t think so quite yet, but away from S&P downgrades and bank funding developments it’s worth highlighting how correlated spreads have been lately, as credit has become “macro” driven.

Chart 8 highlights this point. We show monthly XS returns for a sample of large

high-grade sectors, over time.

- Note that pre-crisis, sector returns were a lot more differentiated – some were up, some were down on a monthly basis. Thus, strong sector views and positioning were valid (and profitable).

- From mid-2011 onwards the trend has changed. Sector returns appear to be a lot more homogenous – in both direction and magnitude. Sector XS returns seem either to be all up, or down now, with not much differentiation (although tier 1 returns are always much bigger than the overall market).

This has been a big story in recent years, but I don’t necessarily think it’s a permanent thing. As I’ve explained before, understanding the macro trends are incredibly important, but the driving force in the last 24 months has been the Euro crisis exclusively. The fear of course is that a Euro collapse is going to take down all assets with it. That’s why the correlations have tightened. It’s fear of a Lehman 2.0 and we all remember what happened to all assets in 2008. That also explains the rally in US Government bonds to some degree. This trend won’t last forever (unless Europe continues to kick the can), but it helps to understand that sector correlations are likely to remain tight until the whole Euro crisis is clearly in the rear-view mirror.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.