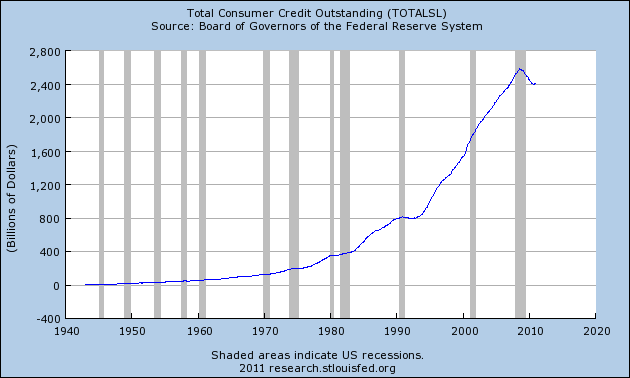

Today’s consumer credit report was in some ways very bullish and in other ways extremely bearish. The Federal Reserve reports that consumer credit increased by $6.1B in December compared to November. Not surprisingly, the analysts were looking for a $2.4B increase so their losing streak on predicting economic data continues. Credit card debt rose for the first time since August 2008. This is all consistent with the better economic data we’ve been seeing lately, however, from a 30,000 foot macro view this is not a good sign.

The US consumer is still sitting on a lopsided balance sheet and needs to de-leverage. The US government and actions of the Federal Reserve have successfully halted this process. While continued spending in excess of incomes is likely a near-term positive, it is certainly a long-term negative as these trends simply cannot persist. At some point the US consumer’s balance sheet must come back to equilibrium. Re-leveraging will likely lay the foundation for a repeat of some sort of economic disruption in the years ahead. The government has halted the market’s natural healing process, but in doing so you have to wonder if they are now making things worse? This is not the foundation from which a healthy secular economic recovery is built….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.