There’s no doubt that we’re crawling out of an unusually deep economic hole. And while I try to remain cognizant of the depth of the recent crisis and how devastating it is, I think it’s important not to fall into the permabear trap that leads people to think that things are now permanently horrible.

One of the more common refrains we’ve heard over the last 5 years references the unemployment rate as a sign that things are actually much worse than they look. And when the headline U3 rate began declining precipitously we started hearing all sorts of persistent refrains about the labor force participation rate and the “real” unemployment rate, the U6 rate. These bearish refrains have been endless and they continue to this day. The only problem is that the longer the recovery goes the more these bearish refrains fall apart.

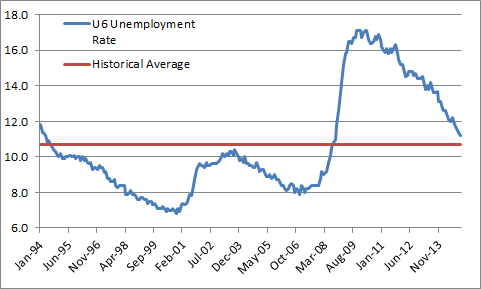

Take the U6 rate, which includes marginally attached workers and people who are looking for full-time work, but can only find part-time work. This broader rate of unemployment, which has been tracked since 1994, is cratering fast. It’s now down to 11.2%. That sounds pretty high, huh? Not really though. The average since the BLS started tracking it is just 10.7%. So yes, we’re still above average, but only marginally.

Don’t get me wrong. I fully appreciate the depth of the financial crisis and how devastating it was. But it would be a big mistake to fall into the trap that things have now become permanently horrible. After all, this is the sort of data that record setting bull markets are made of – just as long as there is slack in the economy it means the rope can be pulled tighter which means there is room for things to get better. And the bull market usually doesn’t end until there’s little to no slack left and the bulls are left, well, hanging themselves on the hope that good times last forever.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.