One of the many myths which appears to persist around QE2 is the idea that the NY Fed is massively overpaying for bonds which would, in effect, amount to a fiscal operation. The idea is simple. If the NY Fed pays $200 for a 7 year bond that is currently worth $100 then they’re essentially “printing money”. Is that really happening though? Not according to the facts.

The nice thing about our increasingly transparent Fed is that they make all of this data available for us online. So we can actually see these operations, what they paid and what the premium/discount was relative to market prices. Unfortunately, we don’t get to see the data in real-time, but we do get to see what’s going on by reviewing recent transactions which gives us a very good idea of what they paid relative to current market prices. For instance, on September 9th the NY Fed executed one of their permanent open market operations. Interestingly, most of the bonds were bonds that had been auctioned off in the last year so it’s easy for one to conclude that they’re “monetizing” this debt. Of course, the Fed can’t and doesn’t “fund” the US government so it’s nonsensical to say such things.

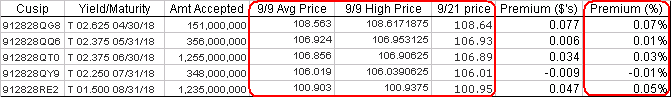

Anyhow, the data shows the average price and high price of the $3.345B operation on the 9th. We can also see today’s current prices (September 21) for these bonds. Now, the prices have obviously moved since the 9th (a week’s worth of trading) but the prices are not far from where the Fed paid. In fact, the premiums are rather small (bear in mind this isn’t the exact price from the day of the operation):

Now, I haven’t gone back and done this for every day during QE2 so the data could vary on different days, but I think it’s clear that we can take the Fed seriously when they claim they are buying market prices or near market prices for these bonds. More importantly, the net interest lost to the banks via the duration reduction is more than offsetting any potential fiscal injection that these bond purchases might be producing. In 2010 that was in excess of $70B that went directly to the Fed which then goes to Treasury in a direct reduction of the Federal deficit.

Is the Fed overpaying for bonds? Not according to the data.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.