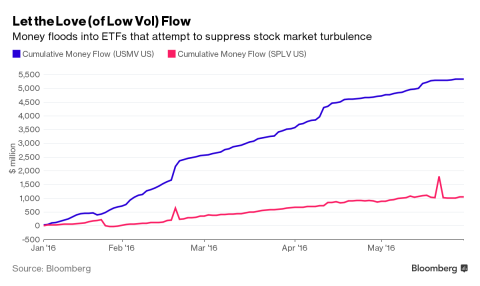

Investors have been pouring money into low volaility funds at a record pace so far in 2016. According to Bloomberg low vol funds have seen higher fund flows than any other ETFs which has prompted some people to wonder if there’s a bubble in low vol funds.

Low volatility funds try to capture what’s called the low volatility anomaly which shows that some stocks with lower than average volatility tend to outperform the market.¹ They do so primarily by capturing exposure to defensive sectors of the stock market which typically leads to a significant weighting in consumer defensive names. In fact, the largest low vol ETFs mirror a consumer staples ETF like XLP with near 100% accuracy.

(XLP vs SPLV since inception)

More importantly, consumer staples and low vol stocks have beaten the S&P 500 by 13% over the last 5 years (since the inception of these real-time ETFs). If you look at a fund like Vanguard’s Consumer Staples Admiral share we find that this outperformance has persisted for over 10 years. More interestingly, consumer defensive stocks fell just 34% during the financial crisis while the S&P 500 fell over 50%. Therefore, you did in fact see real-time outperformance in both nominal and risk adjusted terms across these time periods. But there is good reason to be skeptical of this performance going forward:

- Investors are likely piling into a factor that has worked in the past and might not work in the future. Research from the St. Louis Fed has shown that performance chasing typically leads to negative future results. Additionally, researchers have found that the discovery and popularity of an investment strategy typically reduces its future returns. The recent fund flows and media coverage of the low vol anomaly are signs that investors are both chasing returns and that the strategy is just now becoming mainstream.

- Low vol does not mean low risk. Investors who are trying to substitute equities for bonds or other “safe” instruments are still taking significant equity market risk with exposure to permanent loss risk and could be trading the safety of bonds for a similar exposure to duration risk. Because many consumer defensive stocks are interest rate sensitive they typically have more sensitivity to a rising interest rate environment. In addition to being highly correlated with the broader stock market many investors could find that they are taking a substantial amount of permanent loss risk due to term risk and broader stock market correlation instead of owning safer low duration types of instruments like intermediate term or short-term bonds. This “reach for yield” looks similar to what many investors are doing in high dividend paying stocks where they believe they’re buying an inherently safer instrument that will expose them to significantly more permanent loss risk than most bonds will.

- Recent outperformance means buying expensive stocks. Valuations in the low vol funds have become stretched relative to the broader market thanks to the outperformance. With a PE ratio of 19.6 for SPLV vs 18.3 for SPY there are signs that the outperformance has turned these funds into something that resembles a growth fund more than a defensive fund. This could expose investors to greater downside than we might typically see in a consumer defensive fund. In addition, this is precisely the opposite of the type of countercyclical methodology I prefer since this will tend to overweight the riskiest parts of the equity market at the riskiest times in the market cycle.

As for the question of a bubble? That’s asking the wrong question in my opinion. After all, if there’s a bubble in low vol then there’s almost certainly a bubble in the broader stock market. But that doesn’t mean there aren’t legitimate concerns in these low volatility funds. The primary one for me is the fact that you can own consumer defensive inside of a market cap weighted index fund without trying to time which factors inside of that market cap weighted fund will perform well in the future. Instead, you can buy the whole market and guarantee a lower average tax and fee bill without hoping that you own the factors that outperform. And remember, beating the market isn’t a financial goal for anyone. It’s almost always better to accept an appropriate portfolio rather than trying to time the market and pay higher fees in search of the optimal portfolio.

¹ – See, The Foundations of Factor Investing & “Understanding Low Volatility Strategies: Minimum Variance.” Dimensional Research, August 2011.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.