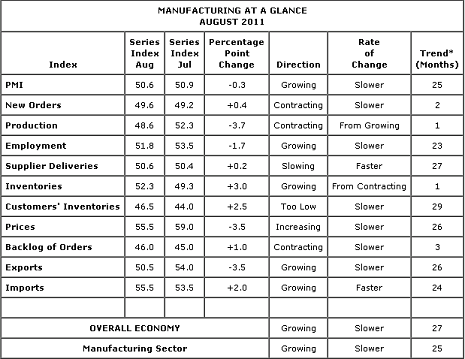

Depressed expectations for this month’s ISM Manufacturing report created an environment ripe for upside surprise and that’s exactly what we got. In fact, this is even better than an upside surprise. The ISM report, which was expected to show a contraction to 48.5, came in at 50.6.

Unfortunately, the data is nothing to get too happy about. 50.6 isn’t exactly consistent with a booming economy and the underlying components are just as weak if not weaker. New Orders came in at 49.6, up slightly, employment declined a few points to 51.8 and prices fell 3.5 points to 55.5. This is all consistent with a sluggish economy, but not a collapsing economy. Sadly, this is the sort of report that Americans are expected to be happy with now….An “upside surprise” where the underlying components show an incredibly weak economy now three years into a “recovery”….

The ISM expands on the release here:

Economic activity in the manufacturing sector expanded in August for the 25th consecutive month, and theoverall economy grew for the 27th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. “The PMI registered 50.6 percent, a decrease of 0.3 percentage point from July, indicating expansion in the manufacturing sector for the 25th consecutive month, at a slightly slower rate. The Production Index registered 48.6 percent, indicating contraction for the first time since May of 2009, when it registered 45 percent. The New Orders and Backlog of Orders Indexes edged up slightly from July, but both indexes are indicating contraction in August at slower rates than in July. The rate of increase in prices slowed for the fourth consecutive month, dropping another 3.5 percentage points in August to 55.5 percent. The overall sentiment is one of concern and caution over the domestic and international economic environment, which is affecting customers’ confidence and willingness to place orders, at least in the short term.”

Source: ISM

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.