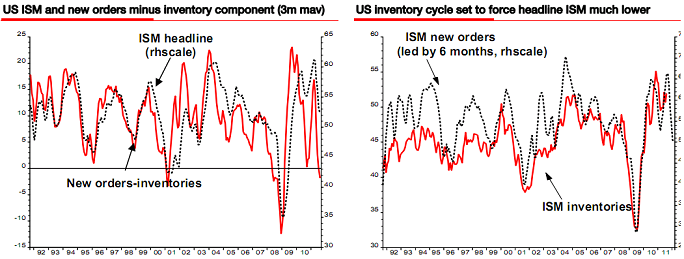

Notable permabear Albert Edwards of Societe Generale, points out an ominous sign in the ISM data. In a recent research report Edwards highlights the US ISM new order minus inventory component. As you can see, there correlation is extremely high between the ISM headline and the new orders minus inventory. What’s so disconcerting about this data is the level of contraction that it is currently pointing to. Edwards details the findings:

“One of the US indicators that has held up quite well and maintained some sense of hope that recession can still be avoided is the ISM which has stayed above the critical 50 level. But further pronounced weakness seems baked in the cake and will disabuse the optimists. The excess of inventories over new orders suggests a very sharp slowdown (see left-hand chart below), and the inventory de-stocking cycle is set to remove one source of component strength from the overall ISM indicator (see right-hand chart below).”

Markets are far from pricing in a contraction as deep as this data indicates….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.