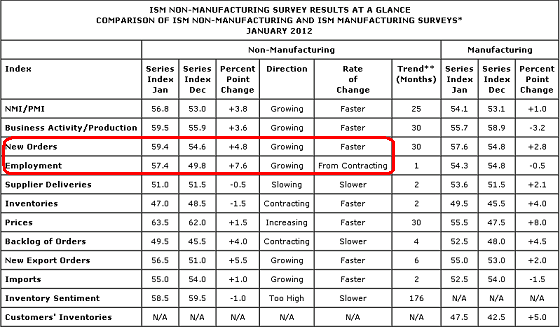

This morning’s ISM non-manufacturing report has taken a backseat to the NFP report, but the data was even better than the employment report. Services industries are showing marked signs of improvement. The standouts were employment and new orders which both surged into the high 50s. The employment data might be

Comments were equally optimistic:

- “Overall business conditions to improve. We continue to outperform previous business cycles.” (Information)

- “We are seeing increased contractor bidding and activity in Q1 2012.” (Construction)

- “Small business borrowing continues to be slow.” (Finance & Insurance)

- “New fiscal year, new budgets — expecting to show an increase in sales in first quarter.” (Other Services)

- “Economy continues to show signs of improvement and the company revenue is improving slightly, but is very susceptible to pricing and cost pressures.” (Professional, Scientific & Technical Services)

- “There seems to be some stabilization in the economy as well as [in the] supply chain. This seems to be calming inventory and sales positions.” (Retail Trade)

- “Business is still stable; however, inflation in food prices is still a problem.” (Wholesale Trade)

That said, it never ceases to amaze me how the pendulum of investor sentiment swings from one end to the other. 4 months ago you could hardly find anyone who was optimistic about the economy. The ECRI was giving their guarantee on recession and Europe was collapsing. Now, we’re swinging to the opposite end of the spectrum….The irrationality of human psychology is the one constant in the marketplace….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.