I’ve been fairly vocal about being in agreement with Ben Bernanke with regards to inflation. I think the Chairman is right not to panic about inflation. Now, he’s totally misinterpreted the impact of his various policies (in my opinion), but that’s another story. The fact is, headline CPI is dominated by motor fuels and as QE2, strong seasonal factors and the Middle East fears die down we should see a moderation in fuel prices. This doesn’t necessarily mean that prices are set to collapse, however, the 40% year over year climb in fuel prices is unlikely to persist through the end of the year. That means a return to disinflation has to be considered at this juncture.

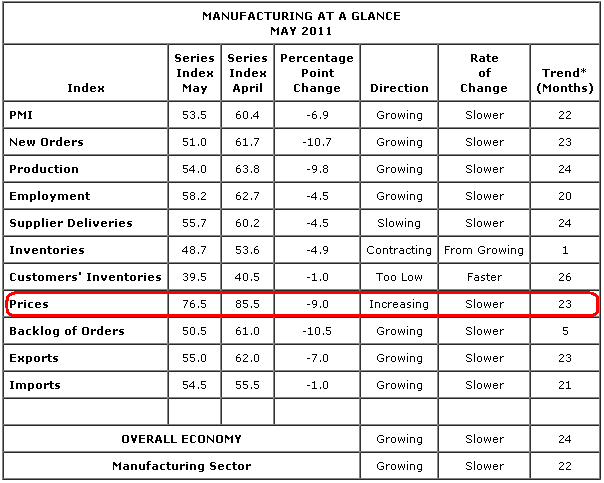

The recent 10% decline in gasoline prices should be a good start. This month’s ISM prices paid component also reflects this transitory effect. Prices were off a whopping 9 points to 76.5. Now, that’s still a very high reading, however, these diffusion indices have a tendency to mean revert so it wouldn’t be shocking to see this figure at much lower levels in the coming months. I think it’s a bit early to say that the commodity rally is dead in the water and that lower fuel prices are likely to result in a return of disinflation, however, one thing is certain – we’re not seeing very high inflation or anything remotely close to hyperinflation.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.