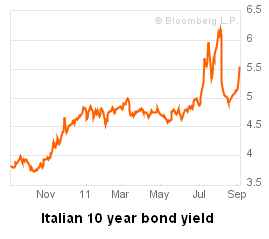

U.S. markets might be closed for the holiday weekend, but Europe surely isn’t on vacation. Italian bond yields are blowing out again and equity markets are getting crushed on this Monday. Germany’s Dax traded down -5.3%, France’s CAC was down -4.7% and the FTSE is off -3.6%.

The story of the day is certainly the Italian bond market where vigilantes are once again hard to work. European leaders remain woefully behind the curve and credit markets are once again in turmoil as a sustainable solution remains out of sight. The latest fears are being stoked by the loss of a weekend election for Angela Merkel’s party in Germany. The wave of anti-bailout fever in Germany is growing stronger. Germany has already stated that they won’t bailout Italy and this almost certainly appears to be the endgame. An Italian default would be almost unfathomable.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.