At this point in the Euro saga, it’s clear that all roads lead to Rome. That is, Italy has become the true endgame. If the contagion in Greece and Portugal spreads then the larger countries like Spain and most importantly, Italy, have the potential to cause massive turmoil in the region. Italy alone carries more sovereign debt than Portugal, Ireland and Greece combined.

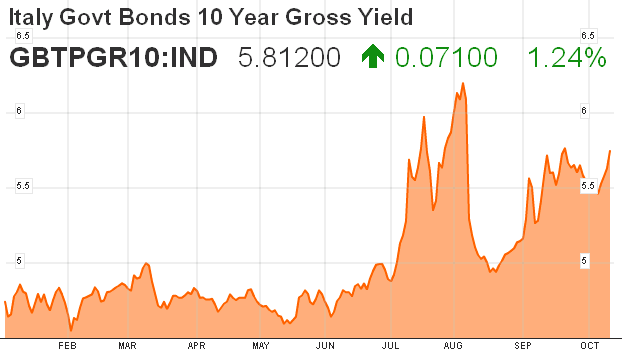

I think the bogey here is still the sovereign bond markets. As our friend Martin noted this morning, credit is not improving in Europe and if Italian bond yields are any sign it’s clear that they’re calling BS on this latest fix. As long as the Euro crisis remains unresolved the bond vigilantes in Italy (yes, unlike the USA, they have real bond vigilantes because of their status as a currency user) will push the envelope as budgets deteriorate and austerity fails to generate a sustainable recovery. Remember, fixing the banks does not fix the currency crisis….

The key for the EMU leaders is to somehow eliminate the solvency risk. As I’ve mentioned many times before, that is the only true long-term fix. We either move towards full fiscal union or we move towards a break-up of the EMU. I think the latter is off the table. That means we will slowly move towards full fiscal union. The big message the Italian bond market is sending is: “the current fix is not a fix at all and we know it”. It’s just more of the same. Europe needs a bazooka in the form of Eurobonds or full fiscal union. I think the bond vigilantes will push this story to its natural end – a panic ending in drastic EMU response involving some sort of long-term fix involving some form of fiscal transfers to the larger sovereigns (E-bonds?).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.