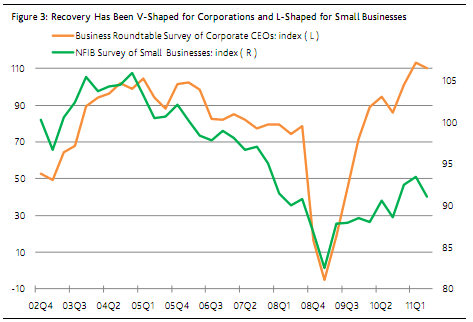

The debates over a v-shaped recovery and l-shaped recovery still rage to this day. Clearly, it’s been a lopsided recovery, but just how lopsided has it been? A recent report from Moody’s puts things in perspective:

“The difference in hiring intentions between small businesses and larger corporations is startling. The membership of the Business Roundtable consists mostly of large US corporations. A recent Roundtable survey of CEOs shows that the 51% expect to increase hiring, well above the 2003 to Q2-2007 average of 37%. In stark contrast, a May survey conducted by the National Federation of Independent Businesses (NFIB) showed that -1% of small businesses planning to hire, down sharply from the 14.6% average of October 2003 through June 2007. (A negative percentage implies that surveyed small businesses intend to cut staff, on balance.)

We see the same picture when we contrast big and small business outlooks. We do this by comparing the readings in the second quarter of this year with the averages for 2003 through the second quarter of 2007. On this basis, the corporate CEOs’ business outlook index was higher by 16.5 points, while the small business optimism index was down by 10.3 points. (Figure 3.)”

Welcome to the l-shaped and v-shaped recovery. Unfortunately for most Americans, the l-shaped recovery is playing a larger role in their lives as small businesses continue to be the primary driver of employment in the USA.

Source: Moodys

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.