If you had told me that oil would fall over 50% in the last 6 months I’d have bet you that the S&P 500 would be down at least 10%+. At a minimum. But that’s not at all what’s happening. Instead, oil has cratered and the S&P 500 is down a mere 3.5%. The 2008 oil price collapse is a common comparison to what’s presently going on in the oil market, but it’s clearly been different this time.

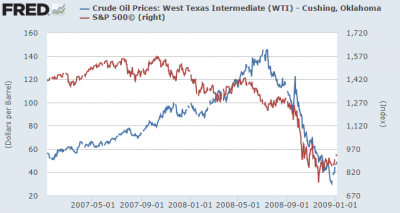

For some perspective on how this actually appears different let’s look back to 2008 when oil last cratered like this:

Not only did the stock market lead the oil markets into the 2008 collapse, but they fell in tandem.

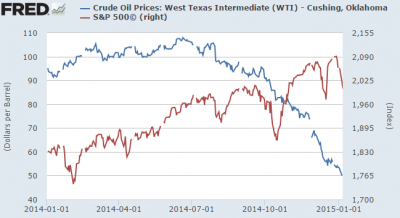

The current decline in oil looks very different, however:

Does this mean it’s “different this time”? Well, so far it has obviously been different this time. And as I like to always say, it’s always different this time. That is, each cycle and each market environment is always its own unique environment. History rhymes, but it doesn’t necessarily repeat. And in my opinion, the stock market’s reaction says a lot about how different the current environment is. Specifically, there is no credit crisis and the current decline in oil is driven primarily by supply issues as opposed to the demand side bubble/bust that we saw in 2008. Does this mean there is no risk of exogenous shocks from the oil price decline? Of course not, but so far I think that the oil price decline has proven to be substantially different from 2008.

PS – I know this post would be a lot sexier if it had concluded with predictions about doom and gloom and the end of the bull market. But my evidence based approach just doesn’t point in that direction so I am sorry to disappoint. One day I’ll qualify to write for the end of the world websites, but not just yet….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.