James Montier isn’t on my must read list for no reason. The latest from the GMO analyst is one of the finer breakdowns of the corporate profit picture I’ve seen a while. On the back of the Richard Bernstein piece I was beginning to do this exact analysis myself, but it turns out that Montier has done all the heavy lifting for me. And he’s done it from the exact same approach I was describing. Montier takes the Kalecki profit equation and breaks down the recent drivers into segments. He shows that the budget deficit has been the primary driver of corporate profits in recent years:

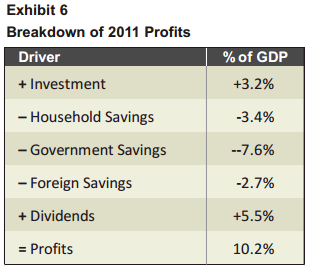

“With this brief tour of the drivers of macro profi ts complete, we are now in a position to see how the various sources have interacted to generate the profits we have actually witnessed. This decomposition is shown graphically in Exhibit 5. Even a cursory glance at the exhibit reveals that net investment has generally been the biggest driver of corporate profitability over time. However, the stand-out engine of corporate profi ts of late has been the fiscal deficit.”

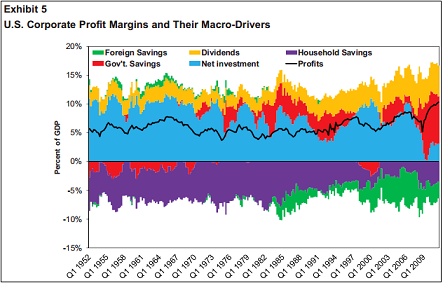

“To further highlight this dependence of profits upon the fi scal defi cit, Exhibit 6 shows the breakdown of profi ts during 2011. The massive impact that the fiscal defi cit has had becomes immediately clear. Government savings have a negative effect on profits; a fiscal defi cit is just negative government savings, hence the double minus sign in the table below”

And his conclusion:

“The government defi cit may stay high this year, due largely to it being an election year. However, it is almost unthinkable that it will remain at current levels over the course of the next few years. As such, unless households start to re-leverage or the current account improves signifi cantly, and assuming that the government moves toward some form of defi cit reduction plan, corporate profi ts are likely to struggle. From this perspective, a structural break in profi t margins looks to be diffi cult to support. So, for the time being we will continue to base our forecasts on the mean reversion of profit margins.”

That’s really sharp analysis. If that all sounds familiar then you’ve likely been reading Pragcap because this is precisely the risk I’ve been highlighting in 2013/2014 as the budget deficit is likely to decline and we’re likely to see stagnant economic growth and declining corporate profits. We’re all clear for 2012, but the risks are plentiful moving forward and if there’s one thing that equity markets hate it’s declining profit margins and profits…..

Source: GMO

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.