Coming into 2016 it looked like there was an increasingly high chance that the weakness in emerging markets posed a serious threat to the US economy. I repeatedly said that the Fed would be irrational to raise rates based on the following:

The risk with rate hikes is creating an extreme divergence in global policy approaches where the US Central Bank, the world’s most important central bank, is tightening policy into a global slowdown. The worry is that this exacerbates problems in foreign markets by increasing capital outflows, puts further upward pressure on the dollar, dings commodities, exacerbates foreign denominated dollar debt problems, etc. In the end, a sharp tightening could come back to pull the US into the global recession hole.

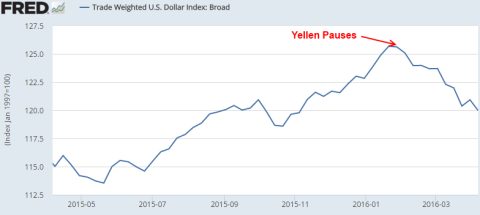

After one rate hike the dollar continued to rally and the financial markets got a little panicky in early January laying the table for a pause. In my view, the downturn in the financial markets was a welcome development as it unwound some of the excesses we’d seen in the previous years. Then when Fed emphasized that they would be cautious raising rates in the rest of 2016 the dollar reversed course:

What we’ve seen since is a 60%+ rally in oil prices, stabilization in commodities and substantial rallies in the global stock markets. This bodes well for the foreseeable future, however, I will reiterate what I said back in January – we’re not out of the woods and a few months of positive price action shouldn’t deter us. The Fed has no legitimate reason to raise rates given the asymmetric downside risk of the current environment. Yellen has played this environment almost perfectly so far, however, it could all come undone with the wrong message in the coming months. That’s a risk we shouldn’t be willing to take. I say hold the line.

*Warning – This article involves nice things being said about Fed officials. If open-mindedness is not in your ideological repertoire you should proceed at your own risk.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.