I’ll keep this short and sweet. I’m not a big fan of the Japanese economy at present or what the policymakers are doing to drive the economy/markets higher. I think they’ve made a mockery of their stock market and that this “wealth effect” is a misguided approach to fixing their woes. But I am equally critical of those who think Japan is on the brink of bankruptcy. Japan’s got big problems – being able to meet its obligations is NOT one of them.

First of all, Japan has basically copied the US monetary design. And anyone who understands the US monetary system knows that the USA can’t just “run out of money”. Even the most simplistic (erroneous) thinking that the US government “prints” money should lead one to understand that a nation with a printing press can’t default on debts denominated in its own currency. I mean, if you had a printing press in your basement would you worry about your credit card bills? This should just be obvious. As Warren Buffett once said:

“The United States is not going to have a debt crisis as long as we keep issuing our debts in our own currency. The only thing we have to worry about is the printing press and inflation.”

Japan is in the same boat. Their debt is denominated in a currency they can always create. So what’s the persistent fuss from the likes of Kyle Bass and some others who keep claiming Japan is on the brink of insolvency? Even an Austrian economist who criticizes the US government for “printing money” should understand that a nation with a printing press and debt denominated in its own currency isn’t going to go bankrupt. So why does this myth persist?

Japan’s got big problems and I wouldn’t go near their economy or their markets with a twenty foot pole, but that doesn’t mean they’re on the brink of insolvency. Saying something that silly might make people think you don’t even understand the most basic institutional structures of the way their monetary system is designed. As for the USA, it’s the same story, but that doesn’t stop the mainstream media and politicians from constantly talking about how we’ve “run out of money”. It’s absurd. And this conversation about whether we “have the money” should just stop. It’s time to get past the basics and move on to the real discussion – the quality and efficiency of spending, how it’s impacting living standards and is it causing inflation?

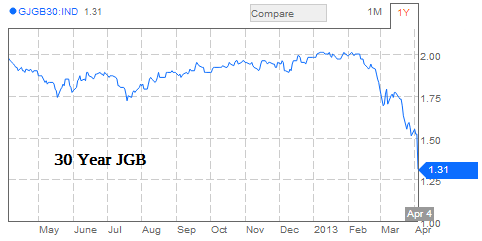

Updated with horrifying 30 year JGB interest rates surging as default approaches:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.