Jeff Gundlach has been laying out his view for 2014 in a presentation this afternoon. As you can likely guess, he’s not super bullish on equities given the huge rise from 2013 and cites many of the common risks of late (sentiment, valuations, anomalies, etc).

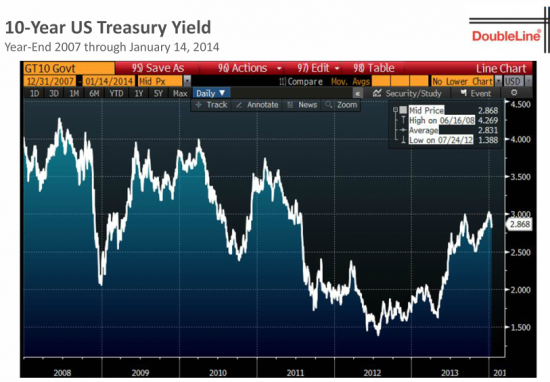

But the most interesting part of his presentation is something that I’ve been thinking about lately. He refers to long bonds as the “ultimate pain trade”. Gundlach says the supply of t-bonds has been reduced due to QE and that the very negative sentiment and short position in t-bonds has set the table for the potential for a short squeeze in government bonds. I think he’s dead right. If the economy surprises to the downside in 2014 then the flight to safety trade is government bonds.

Gundlach says:

- 10 year yields could see 2.5% in 2014.

- “I would NOT have a 0% bond allocation in a diversified fund.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.