Looks like hurricane Sandy had a larger impact than most people are willing to admit. That huge surge in jobless claims (from a 4 week moving average of 365K to 409K) in November was certainly temporary as we’ve now come full circle. Today’s jobless claims data hit a post-recession low of 335K. That brought the 4 week average down to 359K.

Why is this good news?

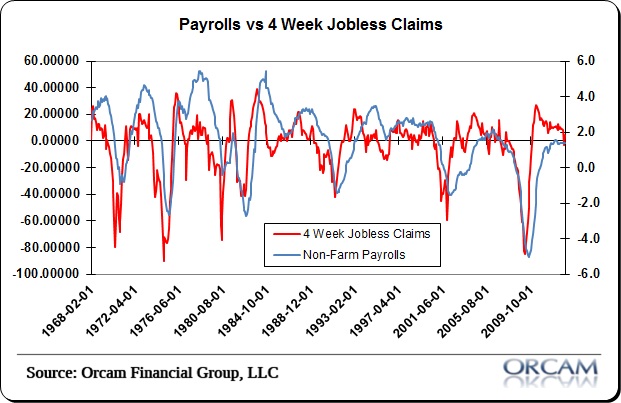

First of all, jobless claims are one of the best real-time indicators of economic activity. We just don’t see recessions that aren’t accompanied by spikes in the claims data. It literally doesn’t happen.

Second of all, the claims data tends to correlate fairly well with the S&P 500. So, what’s good for the job’s market tends to be good for the stock market (more business hiring because they’re seeing better demand, etc).

Lastly, claims tend to be a good sign for the labor market. Non-farm payrolls and the inverted claims data have a very high correlation. At present, the trend is telling us that the growth in jobs is steady.

Things aren’t so bad after all.

(Claims vs payrolls via Orcam)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.