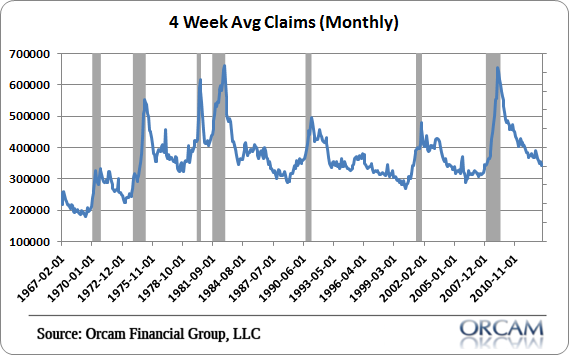

I think you could argue that few indicators provide a better real-time snapshot of the economy than the weekly jobless claims data. In essence, you can obtain a weekly look into the state of the US labor market, which is obviously crucial to the overall economy.

Given the labor market’s importance to the economy, it’s not surprising that the 4 week moving average in claims has been a leading indicator of all 7 of the past recessions. Some people often say that jobs are a lagging indicator, but the jobless claims data has definitely led recessions.

So, where do we stand at present? I think the current reading is still consistent with an economy with substantial excess capacity. In other words, there are still a huge number of people that could be put to work and a huge amount of output that could be created. The latest 4 week average reading of 351,750 is still well off levels we’ve previously seen when the economy was operating at high capacity and at risk of sputtering. That doesn’t mean we couldn’t potentially sputter at a lower level of output, but it would be unusual. Perhaps more importantly, we have yet to see a sustained upward trend develop in claims. So, to me it all looks like continued muddle through.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.