Corporate profits have likely held up relatively well in this most recent quarter as domestic revenues remain stable, international revenues remain strong and corporations continue to benefit from the massive costs cuts. The concern, however, is that these trends are increasingly unstable. I think we’ll see much more caution in terms of corporate outlooks as this earnings season progresses.

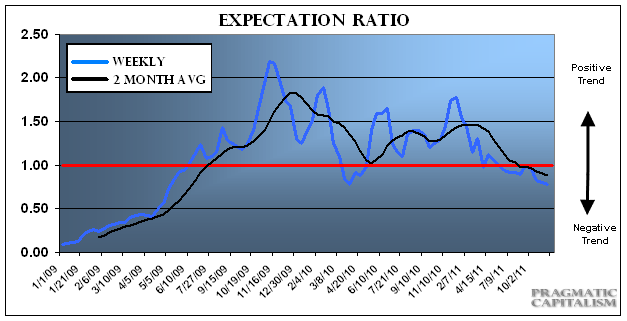

It’s been a while since I’ve updated my expectation ratio, but the story is little changed since the last update. This ratio measures analysts estimates versus a series of corporate metrics that give us an idea of what the market expects compared to reality. The indicator has notched a 2 year low at 0.79. This reading is consistent with a corporate profits cycle that is now widely priced into analyst expectations and at risk of excessive optimism from Wall Street’s analysts. Expect to hear a far more cautious tone over the course of the coming 8 weeks as earnings roll out. Estimates have come down in recent weeks as the ER predicted, but the risk is that estimates are still too high….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.