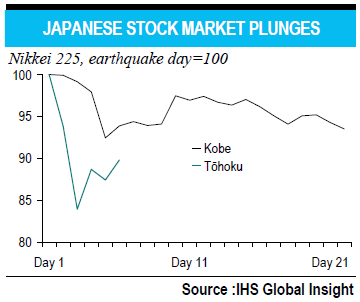

BNP Paribas provides some color on the impact of the Tohoku crisis and a brief comparison of this quake with the 1995 Kobe earthquake. While the damage is likely to be greater the market reaction has also been far more extreme this time around. As several notable investors have stated the sell-off is likely overdone (via BNP):

“It will take time to put an exact figure on the economic cost of the March 11th earthquake and subsequent tsunami that hit Japan. The list of items to be watched is a never-ending one. Insurance claims and reconstruction costs are among the obvious. Following are the impacts on industrial activity, both domestic and global through the partial stoppage of the supply chain, magnified by disruptions in energy distribution, while external trade will be cut because of the damages on seaports and airports. Prices are likely to suffer from a lift, with the sudden disappearance (temporary or more long-lasting) of a substantial part of Japanese production capacities. To all these quantifiable costs you have to add the unknown. The accident at the Fukushima I Nuclear Power Plant is still unresolved, and the threat to populations still difficult to estimate. This uncertainty is the reason why financial markets exhibited a very large reaction, with the Nikkei 225 index down 16.1% between Friday the 11th of March and Tuesday the 15th.

As a comparison, the initial decline in 1995, following the Kobe earthquake, was “just” 7.6%. At the same time, the Yen is supported by massive repatriation of overseas assets. Four months after the Kobe earthquake, the USD/JPY was down from 99 to 83. Since last Friday, it was already down from 81.8 to 78.8.”

Source: BNP

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.