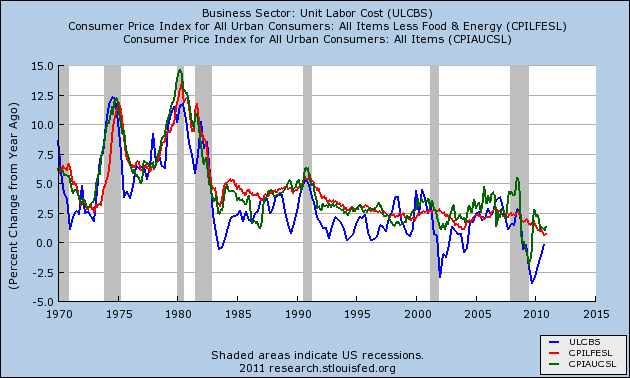

This morning’s report on productivity and labor costs confirmed the low inflation environment that is likely to persist in the year ahead. Unit labor costs declined at a -0.6% year over year rate. This was worse than expected. While this is good for corporations (it ensures continuing high margins) it is bad for the labor market and potential future inflation. The negative print was a record for the post-war period as unit labor costs have now posted 8 consecutive negative quarters. For now, it’s likely that the surging commodity costs in the USA will prove as a burden for US corporations rather than an opportunity to pass on costs.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.