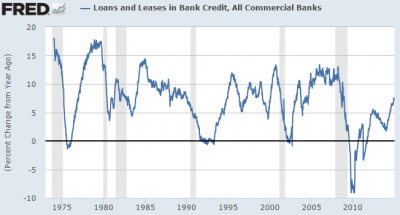

If there was any question that the deleveraging in the USA is over then this is it – total lending in the USA is surging in recent months and is now at the highest levels since the housing boom. The current year over year rate of change in new loans is at 7.2% which is just barely shy of the historical average of 7.3% since 1975:

This is a good sign in general. It means that consumer balance sheets are improving and the number of creditworthy customers is increasing. Most importantly, I don’t think we’re seeing a lot of the “bad” type of lending that we saw before the housing crisis when many of these loans were being made purely for the purpose of speculation on housing prices.

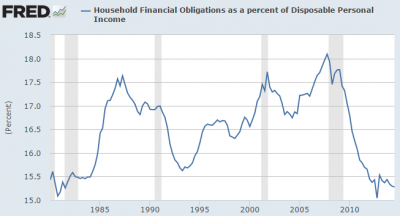

This data was also confirmed by the latest household obligations ratio which has hit a new near-term low:

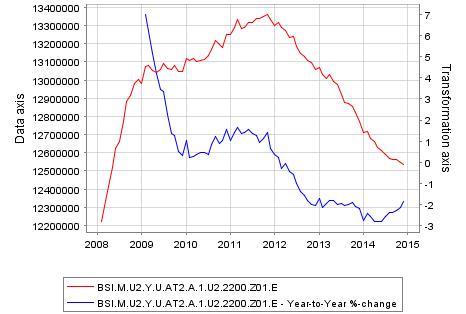

Also, this is very different from the situation in Europe where total lending is still very weak:

As I said back in 2010, the USA managed to sidestep a lot of the mistakes that Europe was making and it’s resulted in a much stronger recovery. The dividends of those policies appear to still be paying off. And now the USA looks to be moving well beyond the “Japan” deleveraging trap.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.