So, Bitcoin is soaring and very few people understand how this will all end and whether these cryptocurrencies will even be viable economic variables. We’re in that early part of a mania when there is a very serious risk that the price of the asset is disconnected from its actual utility.

I call this a price compression. Basically, it means that investors price-in lots of future cash flows into the present and this creates a serious behavioral risk in the asset in the case that those cash flows don’t come to fruition. Think of it like a start-up firm that promises lots of profits in the future and raises tons of venture capital money. The VC’s are bidding up the price of a profitless entity with the hope of earnings in the future. But if the cash flows never come then the valuation and price will decompress.

Price compressions are an element of all financial market bubbles because we don’t really know that much about the underlying assets. There’s a great deal of future promise, but very little real utility. So there’s a lot of guesswork that goes into how those assets get priced at first. But here’s a dirty little secret – you don’t need to be the first mover in an asset bubble to benefit from the development of this new technology.¹

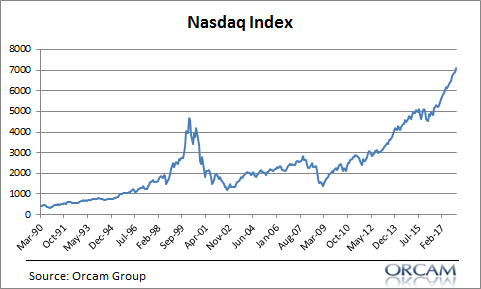

Let’s look at the most classic price compression in modern financial history – the Nasdaq bubble. This was a bubble where you made 10X your money invested from 1990-2000. That’s about 26% per year. That’s turning $100,000 into $1,000,000 by doing nothing. Of course, that’s not what happened to most people. Most people didn’t invest in tech stocks in 1990 mainly because they couldn’t. So they waited until the bubble had already started developing. For most retail investors there were very limited options to choose from and most of the big tech funds didn’t start developing until 1998 or 1999. The Nasdaq 100, for instance, didn’t even roll out until March of 1999. So most investors were already late to the party.

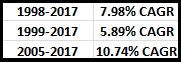

But this didn’t mean you didn’t have time to get in. If you’d invested in the Nasdaq Index in 1998 and held through today you turned $100,000 into $430,000. Not bad at all. If you’d waited an extra year and invested in 1999 you still turned $100,000 into $280,000. But here’s the cool part – if you’d been patient and waited to see how the utility of the Internet would actually play out you could have watched the entire tech wreck, let the paramedics sort them out and perform your own autopsy in the post-bubble era and earned a BETTER return than those eager beavers who dove-in in 1998/9. For instance, $100,000 invested in 2005 has turned into $340,000. Pick a year between 2004 and 2010 and you probably did better than most of the people investing in the late 90’s.

By being patient and assessing the utility of the underlying technology you actually earned a better compound annual growth rate than the impatient people who chased the bubble in its early days.

(Compound annual growth rate of investing in the Nasdaq Index)

The key lesson here is this – as bubbles rise up in new technologies like Bitcoin and crypto remember that you don’t have to chase the early moves to make a lot of money. And in fact, you might do much better in the long-run by patiently assessing the bubble and the potential of a second mover advantage. So, as bubbles develop in certain areas and uncertainty abounds, just remember the early bird gets the worm, but the second mouse gets the cheese.

NB – You win the gold star of the day if you know where the title of this post comes from.

¹ – It’s helpful to make an important distinction here between real savers and real investors. Real investors spend on future production. The company making a new technology is investing in R&D that will enhance its future cash flows. Savers are mostly comprised of people who buy the assets that were used to finance that investment spending. So it’s no surprise that the people who get rich during asset bubbles tend to be the real investors (the innovators) and not the savers who speculate on those secondary market assets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.