Banks aren’t magical money trees. But banks also create money more independently of Central Banks than most economists think.

So, there was a big blow up in economic circles last week when David Graeber published this piece basically claiming that mainstream economics is a mess that needs to be blown-up and totally overhauled. My personal view is that laypeople tend to go overboard with these criticisms of economics. They’re usually empty nonsense like “but economists didn’t predict the financial crisis!!” Yeah, almost no one predicted the financial crisis and it turns that the people who did predict the financial crisis have been predicting financial crises for most of their lives. In any case, the economy is extremely complex and while mainstream economics might be imperfect it’s not in need of being blown up.

Anyhow, one critique that has been fair is that many economists don’t have a very good understanding of finance and banking in particular. I’ve made this criticism consistently and I think it was an important one because finance and banking was at the heart of the financial crisis. But I am not saying that all of macroecon is wrong or bad. Not even close. But on this one specific matter I still think economists miss the mark.

Now, to be fair, I also think there are some heterodox economists who also get it wrong. For instance, much of this criticism of mainstream macro comes from the Modern Monetary Theory and Positive Money people. These two groups often go overboard in their own way and present government spending and banking as though they require no “funding”. This is wrong in its own precise way and the basic story is that everyone funds their balance sheet expansion in our financial system so anyone who says that governments or banks don’t need funding are massively oversimplifying how this all works. But the mainstream econ people sometimes apply a causal link to the banking system’s funding sources that also misrepresent how this works.

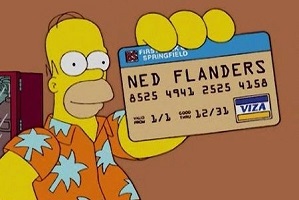

For example, here’s an article from the Financial Times that was being circulated by numerous economists as evidence that the Graeber presentation of banking is wrong. Graeber had described banks as having a “magic money tree” claiming that this money tree can create new money from nothing. The FT piece goes on to criticize Graeber saying:

So individual banks do create money, but their reserves constrain their capacity to do so. New deposit inflows, however, bring with them more reserves. Hence, banks spend a huge amount of time and energy attracting deposits by building branches, or by marketing themselves. If they were magic money trees, why bother? Banks do need to attract customers, even if it is not simply to transfer their funds directly to someone else.

Yes. This is mostly right (and I am not certain Graeber would even disagree). But it’s also imprecise. My friend JKH wrote about this years ago – loans create deposits AND deposits fund loans. We shouldn’t present banks as having a magic money tree (we also shouldn’t present the government as having a magic money tree for that matter). Banks fund their spending and there are numerous constraints on bank lending including demand constraints, capital constraints, monetary policy constraints, etc. But we should also be careful about overemphasizing these constraints.

For instance, many mainstream economists are still leaning heavily on the first sentence above – this idea that reserves precisely constrain lending. We saw this repeatedly coming out of the financial crisis and during QE. Many economists were worried that QE could lead to high inflation if banks started lending their reserves.¹ That has been proven wrong, but we still see many people claiming that reserves constrain lending when in fact the Central Bank mostly accommodates the private banking system’s needs for reserves. In this sense, reserves only very loosely constrain lending because a banking system that doesn’t have sufficient reserves is a payment system that can’t function well and so the Central Bank will respond to provide the quantity of reserves needed. You can say this is a “constraint”, but it constrains banking in the same way that clenching your butt constrains gas. You can only constrain for so long before you must accommodate.²

The reality is that private banks create a very real form of money that operates as a perfectly viable medium of exchange. And they create that money in a manner that the Central Bank mostly accommodates, rather than controls. So yes, it’s true that many heterodox theories have gone overboard dismissing mainstream macro and economics in general. But it’s also true that many mainstream economists still hold on to a fairly imprecise narrative about how much control Central Banks have over the economy and banks.

¹ – The sands under this narrative have shifted with time in what I believe is a rather disingenuous dismissal of reality. Many economists now claim that they didn’t mean the money multiplier to be exactly true. Instead, they simply meant it to be a loose ratio. Or worse, they claim that the money multiplier is still true, but that interest on reserves incentivized banks to hold reserves rather than make loans. Give me a break. As if 0.25% income stopped banks from making low risk higher interest loans from 2008-2015 when the Fed Funds Rate was 0-0.25%.

² – It’s beneath me to make fart jokes on this website, but I wanted to see who is still paying attention.

Related:

The Myth of the Money Multiplier

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.