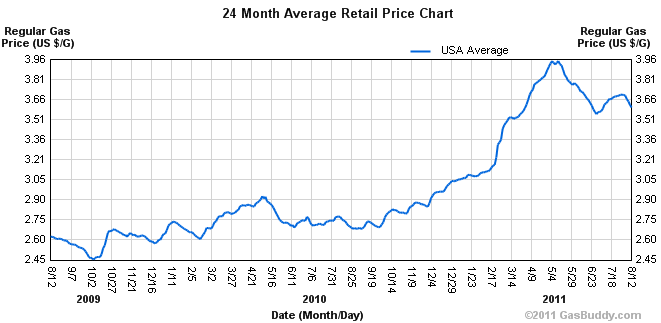

The recent decline in oil and gas prices should lead to lower headline CPI. As I noted earlier this year, motor fuel has been the primary driver of the headline prices this year. According to Gasbuddy.com prices should continue to move south in the coming week:

“Wow how a week can change things! Amid oil prices beginning last week slightly higher, virtually everything came to a grinding halt on Wall Street as a negative manufacturing report was issued. Wall Street saw a correction and took oil prices with them. By this Monday morning, oil prices had lost over 15% of their value from last week. At this writing, oil prices are flirting with $83/bbl after starting last week close to $100.

What’s this mean for a good majority of motorists? Rather simply- falling gasoline prices! Gasoline stations will slowly start purchasing and filling their tanks with cheaper gasoline and pass along part of the savings to you.

…By next Monday, the U.S. average may fall to $3.54 per gallon while prices in Canada could fall to 121.6c/L. Be sure to only buy what you need as I expect prices at the pump to decrease nearly daily! Diesel prices will also be falling, so truckers can rejoice as well.”

Source: Gas Buddy

Source: Gas Buddy

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.