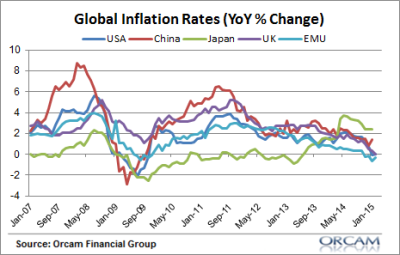

It looks like the flation debate has been won, resoundingly, by anyone who thought that QE and record high government deficits would not be inflationary. In fact, it’s been won so resoundingly that you can’t even call this INflation any longer. When we look around the world the term INflation is misleading since so many countries are actually stuck in a DEflation.

So, let’s look at an overview of the current situation. The global flation picture shows broad levels of deflation and low inflation:

Europe continues to look the most “Japanese” thanks in large part to their unworkable monetary union. The USA’s headline rate of inflation is also deflating at a rate of -0.2%, however, the core rate actually rose a bit this month to a level of 1.7%.

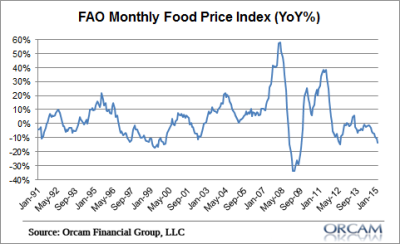

If we look at some of the drivers of the global lowflation we can see the extreme impact from food and energy. The GAO world food price index is declining at a rate of -14%:

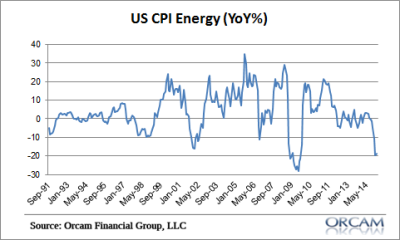

Likewise, energy prices are collapsing at a rate of almost -20% a year:

It’s interesting to think about the extreme nature of this environment going forward because a marginal bump in inflation will make the year over year comparisons in 2016 look rather high. It all makes me wonder if we aren’t seeing a bit of near-term capitulation in the deflation trade….The Peter Schiffs of the world look pretty silly right now, but 2016 might just be their day in the sun….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.