The week is starting out with a bang as markets slide more than 1% to start the week. I’ll keep this brief and to the point. As you likely know, we’re in a balance sheet recession. That leaves an inherently weak private sector where spenders have been forced to turn into savers. Thus far, the government response has been adequate enough to help households repair their balance sheets and sustain some level of growth. That support is now threatened by austerity talks and slowly coming off the board as the stimulus wears off. As I’ve long said, the other big risk in this sort of an environment is the exogenous risk. Today, that appears to be Europe and China. More specifically, it is Europe right now.

As Mike Norman noted earlier today, the Euro crisis is spreading far faster than anyone assumed it would. CDS spreads at the core are now surging.

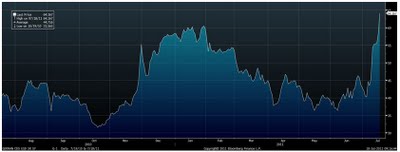

Many assumed Spain was the last in the line of dominoes here, but the problem has now gone right past Spain and Italy now becomes highly problematic. Yields in Italy are surging again today. The politicians are way behind the curve here as they let the markets take yields for a ride that will exacerbate the problems.

Gold and silver are surging in what appears to be an anticipation of market weakness leading to more QE. Silver has become the single most important barometer for QE. QE2 helped fuel the bubble in silver prices over the last year and it wouldn’t be shocking to see a similar response if the Fed should implement QE3. As I mentioned following the job’s report, equities are back in high risk mode in my opinion.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.