Asset allocation is all about matching future expectations with your future needs. The problem with doing this is that our future needs are only loosely known and predicting the future of certain asset class returns is incredibly difficult. Still, there are some basic principles we can apply to this endeavor that increase our odds of success. For instance, we don’t really know what any single entity will return in the future, however, we can be fairly certain that an aggregate of instruments will generate a certain positive return over a long enough time horizon because the macro drivers of corporate growth tend to trend higher.

But what about an entity like Warren Buffett’s Berkshire Hathaway which is essentially a mini aggregate of many private and public companies? Is this a good middle ground option for someone who is looking to take a little more risk than an index, but doesn’t want a huge amount of single entity risk? I would argue that there’s a very simple reason why Berkshire is no longer an attractive asset for diversification – it’s become too large to rationalize the increased single entity risk relative to something like the S&P 500.¹

Here’s the thing about Berkshire – while it’s been one of the best performing stocks of all-time there’s a reasonable argument to be made that there just isn’t that much relative upside to be had here in its current form. As Berkshire becomes larger and larger it gobbles up more market share from every industry it competes in. At $369B in market cap Berkshire is one of the largest corporations in the world. And the problem with this sort of fantastic growth is that the more market share you eat up the more you become “the market”.

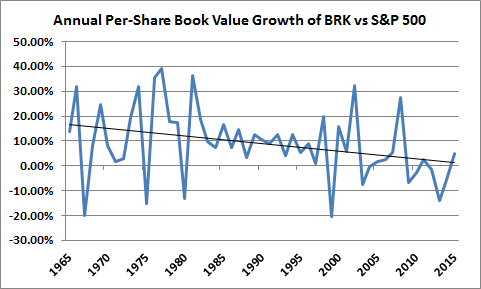

This isn’t just opinion. Here’s the damaging chart that shows what’s happening to Berkshire:

In essence, Berkshire’s annual growth in per-share book value is collapsing relative to the S&P 500. Berkshire has become a victim of its own success. By becoming such a big part of “the market” Berkshire has started to correlate closely with the market. We’re at a point where the rolling 5 year relative book value growth is almost 0%. Buffett knows this all too well. It’s a frustration we’ve heard from Buffett himself as he has stated that he no longer has the flexibility to purchase smaller higher growth companies because they won’t have an impact on earnings. So he’s out there with his 50 caliber every day searching for the “elephant” that will meaningfully add to per-share book value. We’ve seen some of these big purchases in recent years but even these “elephants” like Burlington Northern can’t seem to stop the decline in relative book value growth.

What Can Berkshire Do to Change this Trend?

This is not an easy position for a conglomerate to be in. Buffett is essentially a micro diversifier. But he’s diversified his company to the point where he has to macro diversify. Berkshire is just too big to be a micro diversifier now. So, the obvious answer is that Berkshire has to become something different in order for it to continue to generate meaningful relative value. This means one of two things most likely:

- Berkshire will have to break-up into smaller companies that offer shareholders more streamlined revenue sources offering greater future flexility in earnings generation.

- Berkshire will have to become a foreign company that diversifies its current income streams into foreign higher growth markets.

Neither of these options are all that viable under the current leadership. Which means that the new Berkshire, headed by Buffett’s transition team, will have to take some bold actions in the coming decade. In my opinion it’s hard to justify owning Berkshire until you see a meaningful push in one of these two directions. The relative diversification of income just doesn’t justify owning what has essentially become a big index fund at this point with added single entity risk. People sometimes talk about this transition as though it’s the end of Berkshire, however, bold and intelligent transitioning might be just the thing that makes Berkshire great again.²

¹ Yeah, yeah, I know I am a macro guy so what the heck do I know about micro? Well, as it turns out I was a pretty good micro stock analyst back in another life so take that!

² – You can make the hat for this.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.