Not a lot of news today, but there are some interesting goings on in the market:

- Portuguese 10 year bonds are hitting all-time highs today at 7.5%. The ECB had to step in again to help smooth the market. Portuguese government officials have come out to reiterate their belief that they don’t need help, however, these yields are simply unsustainable. The Portuguese are going to need aid in the coming quarters. At that point the markets will turn to Spain. With rising inflation across Europe we have to begin to wonder how much political will exists for an increase in the EFSF? Ultimately, I don’t see how they can ever let anyone fail. It’s been made very clear that defaults are not an option. Some difficult decisions are going to be forced upon European leaders in the coming months. Signs of economic weakness could prove truly traumatic – particularly for Greece and Ireland. This constant government intervention is generating stability for now, but one has to wonder if it isn’t setting the table for even greater instability down the road. The lack of decisive action in Europe is not reassuring. The Trichet Put is working for now, but can the good times last?

- The long held belief around options expiration is that the markets rally into expiry and sell-off in the week after. Could this prove to be the catalyst for a market peak?

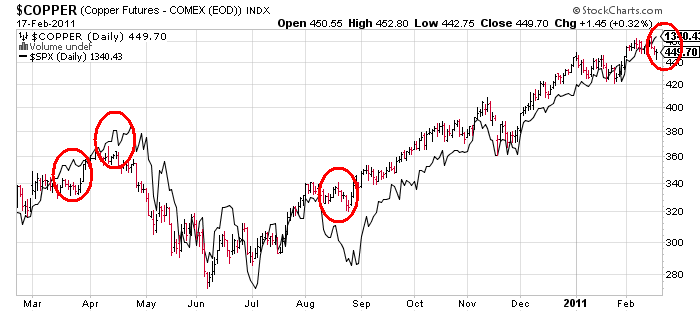

- Copper prices have been notably weak during the course of this week’s market surge. With the S&P 500 up 1% copper prices have declined -1%. This divergence could be a sign that the equity markets are getting ahead of the fundamental story. Clearly, one week does not make a trend, but it’s worth noting that these divergences have proven to be prescient over the course of the last year.

- In the long-term, the thesis has not changed much. Modest domestic growth and strong growth abroad are creating a positive equity environment, however, one has to wonder if the 55% annualized pace in the S&P 500 this year is sustainable in the near-term. Common sense would tell me that it is not….But who knows at this point. The Bernanke Put has changed everything….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.