Another busy morning as news out of Japan, the Middle East and the USA rattle markets.

- US housing starts fell to their lowest level since April 2009. At 479K, the declines were much steeper than expected. This -22.7% annualized rate is consistent with the double dip we’ve long been expecting. The month over month decline was the largest since 1984. Housing is clearly still in the dumpster and while spring time may bring some rays of light I would expect the poor fundamentals to continue to exert pressure on home prices.

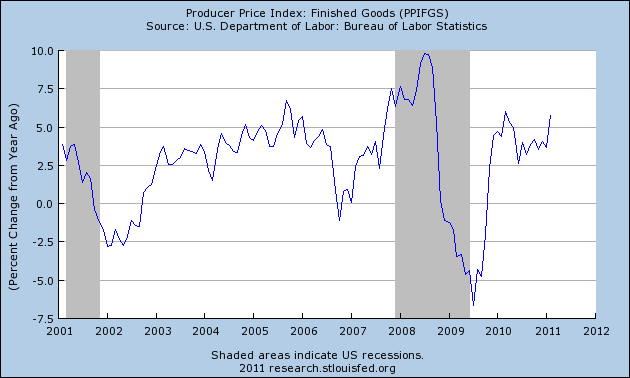

- PPI surged to an annualized rate of 5.8%. Analysts were looking for just 0.7%. The core reading came in at 1.9%. It’s clear that the surge in commodity prices is backfiring on Mr. Bernanke. The average consumer spends 65% of their paycheck on food, housing and energy related costs. With housing in the dumps and food and energy costs surging it’s hard to see how QE is helping consumers. The surge in producer costs is certain to hurt corporate margins as I’ve long expected. I continue to be dumbfounded by the implementation of QE. This morning’s PPI has to seriously make one ponder whether this program isn’t detrimental to the US recovery.

- There are reports that the Treasury canceled this morning’s POMO. There was no reason given, however, I can’t help but wonder if they are interested in seeing how the market will respond. Clearly, investors don’t like the news.

- The news of the day is again about Japan though today’s market moving commentary comes from the USA. Steven Chu, the secretary of energy, says there has been a partial meltdown in Japan (via the NYT):

“In response to a question from Representative Doris O. Matsui, a Democrat from the Sacramento area, about what would happen if there were a complete meltdown, Mr. Chu replied, “We think there is a partial meltdown, but as you correctly noted, that doesn’t necessarily mean the containment vessel will fail. (In fact, Japanese officials say that the containments at two of the reactors appear to have failed.)”

- In the Middle East there are reports of Bahrain spiraling out of control. Security forces are carrying out a brutal crackdown on any and all protesters. It’s amazing that this story is taking a backseat to anything, but that’s the environment we are in….Buckle your seat belts. As I mentioned the other day regarding cash – this is one of those times when cash is most certainly not trash….

Update – POMO was delayed and has been completed.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.