There’s been some cautionary commentary in recent months from some bond market heavyweights. Most notably, Howards Marks and Jeff Gundlach. In a Bloomberg interview today, Marks said you need to be cautious about low quality issuers:

“When things are rollicking and the market is permitting low-quality issuers to issue debt, that’s when you need a lot of caution,”

And just a few weeks before that Jeff Gundlach referred to junk bonds as the most overvalued they’ve ever been relative to Treasury Bonds.

And at various points during the last year Dan Fuss of Loomis Sayles has made similar comments:

“[high yield bond valuations are] absolutely, from a valuation point, ridiculous,”

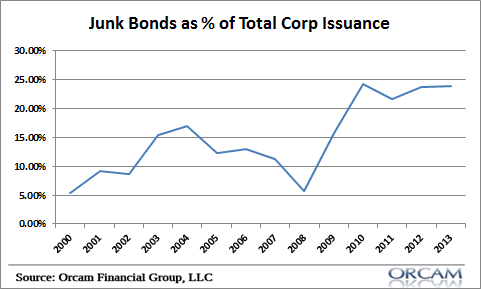

Of course, this is precisely what the Federal Reserve wants. They want to make financing as inexpensive as possible with the hopes to drive private investment higher and ease debt burdens. If we look at issuance, corporations have been happy to play along. High yield bond issuance hit a record high in 2013 and as a percentage of total corporate issuance, is high by historical standards. And that means the structure of the corporate bond market is likely on a weaker foundation than we’re used to.

As for valuations – your guess is as good as mine. ZIRP has forced a lot of traders to throw the old playbook out the window. But we do know that the structure of corporate credit is resting a great deal of hope on what is expected to be low historical default rates and “junk bonds” that aren’t expected to perform quite like they’re all that junky. I’d say it’s different this time because of Fed policy, but that’s not really applicable considering that we have a credit based monetary system and defaults are just part of the inevitable cycle….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.