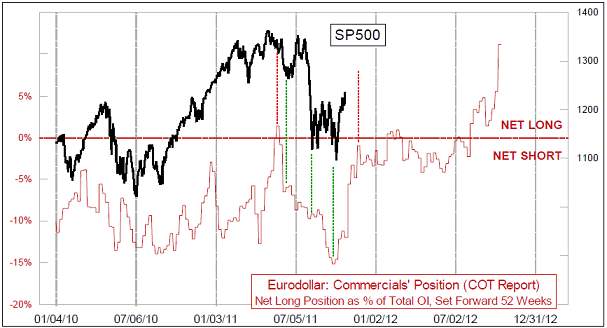

I don’t want to imply that correlation equals causation, but Tom McClellan’s latest research piece had an interesting chart of the day tucked away:

“With a Timing Model top due around now, and with an arguably overbought market, it seems appropriate to scale back a little bit after such a big rally. So I’ll be taking the leverage off for managed accounts in the Stock Optimizer program on Friday (contact Global Investment Solutions for more information about that and other programs).

But I don’t want to convey the idea that the uptrend is over, not at all. The leading indication for stock prices from the eurodollar COT data is shown in the top chart on page 2, and we are right now still in the big accelerated up move phase that this data told us about a year ago.

We’ll reach the shoulder of this pattern about a month from now. Knowing the exact date suggested by the pattern is not terribly helpful, because the stock market does not always make its turns at the exact date. But the point is that there is still more upside ahead for our intermediate term (several weeks) picture.

The first half of 2012 will once again be a great “trading” environment, and a lousy “investing” environment, but we can address that as the time gets closer. For right now, there is still an uptrend to harvest.”

Source: McClellan Financial

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.