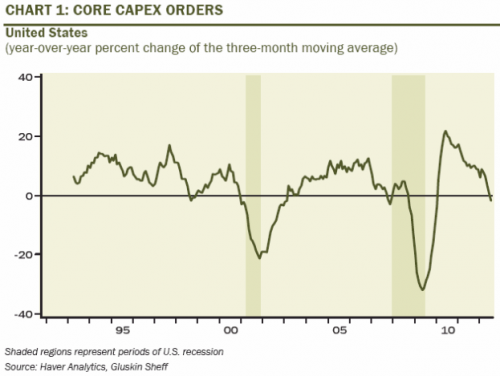

I’m filing this one in the interesting, but obscure indicator file. According to David Rosenberg, Paul McCulley likes to look at the 3 month moving average of core capex orders as one of his preferred economic indicators. As Zero Hedge notes yesterday, it’s not looking good for this one:

“Paul McCulley, the former legendary economist and fund manager at PIMCO, who was once being touted to join the Fed as a policymaker, told me last year at the Altegris-Mauldin conference, the YoY trend in the three-month moving average of core capex orders had for a long time been his preferred indicator of how the broader economy was going to fare a few quarters into the future. Well, if you are bullish on U.S. growth prospects over the near-term, I suggest you look at the chart below.

Notice how the YoY trend just sliced below the zero-line in July (to -1.7% from +1.1% in June).Only once in the past did this NOT tip the overall economy into recession and that was back in September 1998 when the Asian crisis was at its peak, LTCM had to be wound up and Russia defaulted … not exactly a pretty sign even if the recession was delayed for another two years.

In terms of sectors, it was order declines in machinery, electrical equipment and communications equipment that far outpaced gains in metals, autos, aircraft, and computers.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.