Modern Monetary Theory (MMT) is in the news a lot lately and has grown especially popular with non-economists and people who are attracted to the large government spending possibilities it promotes. MMT advocates frame the theory as a superior option to mainstream economics, but often cherry pick or misconstrue mainstream concepts while promoting their own vaguely accurate concepts. This has led to significant pushback from mainstream economists as well as other heterodox economists who are uncomfortable with the overly simplified treatment of many well established concepts. And while MMT has some interesting insights to add to our understanding of economics they also promote many concepts that are misleading at best and downright wrong at worst. So let’s dig in and see what’s good and what’s bad in MMT.

This post will provide an explanation of MMT and communicate, in layperson terms, what is good, bad and ugly about MMT. I hope you find it helpful.

First, it’s useful to provide an overview of what MMT actually is because this is what trips most people up. While MMT is often communicated using simplistic explanations it is actually a complex theory. MMT is a macroeconomic theory of full employment and price stability that argues that the government is the monopoly supplier of money. Because it prints THE money (currency) it can always afford to spend in nominal terms. In other words, the government cannot run out of money. This also means that the traditional idea that the government needs money before it spends is misleading. The government doesn’t need our tax dollars to spend money because it can literally print money if it has to.

Further, the government causes all sorts of problems by creating a currency. This includes the need to obtain money from the government to pay taxes in the money that it creates as well as the need to obtain jobs so we can obtain an income denominated in the currency that the government requires those taxes to be paid in. So, MMT argues that unemployment and a shortage of desired financial assets can result if the government does not spend enough into the economy. They propose to resolve this mainly through a Job Guarantee program that would provide full employment to everyone willing to work. The Job Guarantee is an essential part of the theory because it is the element that supposedly solves the problem of full employment and price stability.

Importantly, MMT does not say deficits don’t matter or that the government has NO constraint. While the government has no nominal budget constraint it does have a real budget constraint (ie, inflation). Therefore, deficits matter greatly, but not because the government could run out of money like a household, but because it could cause high inflation.

Okay, I don’t agree with all of that, but it’s a decent general description of how the monetary system works. Anyhow, moving on….

The Good.

1) MMT gets banking (mostly) right.

This is a biggie because mainstream economists have had this confused for a long time and it’s distorted the way we emphasize certain policies and ideas. The traditional money multiplier is wrong and MMT advocates have long emphasized endogenous money.

2) Fiscal Policy over Monetary policy.

Mainstream economics relies heavily on interest rates and the powers of Central Banks to set policy. MMT turns a lot of this on its head and argues for more fiscal policy focus and less monetary policy focus. Concepts like the natural rate of interest and NAIRU have rightly come under attack and it’s nice to see MMT shedding some doubt on these ideas that are pretty central to mainstream economics. This is particularly relevant in an age where it appears as though Central Banks have become somewhat impotent.

3) Governments have an inflation constraint and not a nominal constraint.

This is important because most people think of the government like a household. When a household runs out of income it probably cannot spend. It has a true nominal budget constraint because intra-sector entities and persons are subject to bankruptcy laws. When a federal government wants to spend and doesn’t have enough income it just runs a deficit. The only thing that stops the government from spending too much is when its spending causes out of control inflation.

Again, this is useful because it gets people out of the mentality that deficits are necessarily bad or that the government can’t “afford” things just because it doesn’t cover them entirely with current tax receipts. As mentioned before, it also gets us out of the mentality that all government spending and debt is going to cause hyperinflation.

On the other hand, MMT exaggerates this concept and would lead us all to believe that mainstream economists and Congress believe in a household budget constraint. Reality is not remotely close. During Covid the US government spent over $25T and ran deficits of $7T over 3 years. Fiscal policy and government spending has been extremely loose for a very long time. So while most laypeople might think of the government as a household it’s pretty clear that most economists and Congress do not.

The Bad.

MMT relies on vague definitions, sloppy generalizations and several misleading accounting portrayals to promote a politically motivated movement. Many of these generalizations are vaguely right at a macro level and are quite literally wrong at a micro level. This section will detail many of the errors here.

As a whole MMT will appear quite new to the layperson who first encounters it, but experienced economists will recognize that MMT is a mix of some new ideas and some very old ideas. Unfortunately, some of the new ideas are so twisted that even experienced economists will misunderstand them in large part because MMT changes many well established definitions. As Thomas Palley, a Post-Keynesian once said of MMT: “what’s new is wrong and what’s old is well understood“.

MMT is comprised of several different elements. The State Theory of Money is an old Knapp theory. Endogenous money is an old concept. The Job Guarantee is an old Marxist and Minskyan idea. Sectoral balances is an old Godley concept. Even resource constraints are old hat. Some of these are controversial topics, but not unique to MMT. What is unique to MMT is ideas like “taxes don’t fund spending”, their misconstrual of reserve accounting and their treatment of some aspects like private sector savings are regularly used to over-simplify the way Godley presented a much more complex picture. Palley was right. The old stuff is well known and the new stuff is either wrong or misconstrued.

4) MMT’s Operational Description of Funding is Wrong.

When you first encounter MMT you will have to adapt to the idea that government bonds do not necessarily fund government spending. MMT is right about this. The government has a printing press and could theoretically print cash or credit accounts when it spends. They do not have to fund spending from bond issuance. But MMT takes this concept too far by saying “taxes don’t fund spending”. MMTers love to berate Conservatives for claiming that government spending needs to be “paid for” with taxes and they’re right. The government does not have to fund all of its spending from current income ($ for $). The government doesn’t have to balance its budget and it doesn’t have to pay back the national debt. But saying “taxes don’t fund spending” is also rhetorical overreach, except in the opposite political extreme.

In a 2024 Twitter post Stephanie Kelton clearly communicated how warped their view on this issue is. She said:

This is just completely wrong. The government sells bonds to run a deficit. This isn’t just changing the composition of outstanding assets. It is explicitly adding assets via bond creation. MMT is playing dirty pool with this concept by implying that the Treasury Bond is just being swapped for central bank reserves. But as we’ll explain below this is both legally wrong (the Fed literally cannot finance the Treasury like this) and misconstrues the entire reason reserves exist in the first place. But in this specific instance the Treasury has to sell bonds to procure the reserves that go into the Treasury General Account (TGA). But MMT is acting as though the reserves were created for government spending and that the Treasury swapped those bonds for reserves. This is not what happens in reality. In reality the Treasury sells bonds and then the Fed credits the TGA with reserves after the fact.

MMT’s treatment of bond sales is not nearly as bad as their treatment of tax receipts though. We should be clear that taxes absolutely, positively fund government spending. Every single entity in the economy needs income and benefits from having income. Income gives us credit and without credit no one would hold your financial assets. When the government spends, it does so, in part, by taxing existing resources and redistributing some of the value of those resources. When the government taxes us we extract some of the monetary value of the resources we produce and redistribute it to the government for public purpose. A government that has more access to resources has more funding because it can tax more (and spend more without printing money) and a government with fewer resources has less resources and funding capacity because it cannot spend by taxing and must instead print money to spend (and cause inflation). When MMT people say “taxes don’t fund government spending” and “resources constrain government spending” they are explicitly contradicting themselves and using a clever (but sloppy) rhetorical trick to make people think they’re saying something new and original. They are not.

The key point to understand here is that the government (or banks) is just a liquidity provider who relies on monetizing private sector assets to be able to spend sustainably. This is how all credit based systems work. The ability to issue money isn’t the thing that gives the government power. It is the resources of the private sector that ultimately allow the government to be able to issue money in the first place. But in MMT the power resides with the government and the private sector is framed as being reliant on the government to issue currency. This is backwards. Capitalists do not rely on government to issue currency. Government relies on capitalists to build the resources that give the government fiscal space to be able to print money in the first place. But in the MMT world this is all presented backwards and the reader comes away thinking that we’re all sitting around twiddling our thumbs waiting for the government to issue currency and “net financial assets”. In reality, valuable corporations and resources very much fund government spending as they create the economic value that makes all money creation viable.

Let’s use a concrete example of spending and taxing in the USA. As of 2022 the US government spends about $6T per year. About $4T of that comes from taxing existing income and assets. The other $2T comes from printing money (running a deficit). That $4T is money/value that already exists and is merely being redistributed and much of that value is created endogenously in the private sector. If this $4T of value did not previously exist the government would not be able to spend $6T per year without creating much higher inflation. The US government isn’t able to spend a lot because it has a printing press. It’s able to sustainably spend a lot because it has an enormously productive private sector that creates abundant resources that the government can redistribute. When the private sector mobilizes resources and creates value they are creating the fiscal space that makes government spending viable in the first place.

Another simple example is to consider two new economies where we form a government and agree to use a common currency that is issued endogenously via bank loans. Economy 1 is filled with people who sit on the beach all day and do nothing. Economy 2 is filled with people who invent Microsoft using bank funding. Microsoft Corp provides labor and income to its residents and also soars in value because of its technological advancements. As a result the citizens of Economy 2 are far wealthier than the citizens of Economy 1. If you have a government involved in all of this then the citizens of Economy 2 can use that government to tax some of this wealth and spend more than the government in Economy 1 can. In other words, Economy 2 is far better off and its government has more funding via taxes because its citizens endogenously innovated and created wealth that wouldn’t otherwise exist. And we should be clear about this – Economy 2 can spend by taxing this wealth, monetizing some of the resources and then redistributing the money for public purpose. The taxes explicitly and directly fund the government’s ability to spend without creating inflation. Economy 1 can spend as much money as Economy 2 by just printing new money, but they will simply create inflation because they didn’t create the real value and resources along the way to support new money creation. Keep in mind that there was zero government spending to fund or finance Microsoft’s creation, but Microsoft’s value creation gives us the ability to redistribute assets for public purpose without creating inflation.

Of course, MMT would say that the government had to create the money before it could be taxed, but the government did not create that money and value. That money and value was created endogenously in the private sector and the only reason the government can tax it is because the private sector invested in real resources that gave them value. This is precisely how banking and investment spending works in the modern day economy – firms borrow, spend for investment, wealth grows and the government can tax that wealth. The government can also deficit spend so MMT is correct in saying that the US government doesn’t have to “pay for” all its spending $ for $, but they’re wrong in saying that the government doesn’t tax to fund spending.

In a technical sense, anyone can spend without income. Microsoft Corp doesn’t have to spend only from its current revenues. It can issue bonds or equity to fund its spending and people will happily hold those assets because MSFT is a highly credible entity. But the only reason anyone is willing to hold those assets is because MSFT has a huge amount of revenue that gives them credibility. It makes no sense to say MSFT income doesn’t fund its spending because MSFT income is what makes its financial assets valuable in the first place. It’s circular logic to say taxes don’t fund spending and inflation constrains spending because a government without income would have no credibility and super high inflation.

MMT people like to say “resources constrain government spending”, but conveniently leave out the fact that most resources in the economy are mobilized by the private sector. Therefore, the government has more spending capacity when the non government creates resources. Economic “resources” include things like land, labor, capital and technology. When the private sector creates and mobilizes resources the government has more funding because they’re able to tax and redistribute some of those resources and value creation. Importantly, this is often endogenous value creation and that value creation gives the government greater purchasing power than it would otherwise have.

Yes, the government has a printing press and can print money whether we build resources or not. But the kicker is that when we build real resources we have the ability to tax new endogenous asset value creation that is already supported by existing resources thereby resulting in the ability for the government to tax and enact public purpose WITHOUT having to print money. MMT wants to frame this to give the appearance that the government doesn’t rely on the private sector to be able to spend, but the government does rely on the private sector to create resources and give it the fiscal space to be able to spend. And taxation is how the government moves some of that endogenous resource value to the public domain for public purpose. This can be a good thing as it redistributes spending power from wealthy people with a low marginal propensity to consume to less wealthy people with a higher marginal propensity to consume. This could reduce inequality and could boost aggregate demand.

One crucial difference between a household and the government is that the government operates with a much more flexible line of credit because it can tax all domestic output without needing to worry about being taken to bankruptcy court (the government won’t willingly choose to default on itself and so it has no solvency constraint like your or I do). Instead, when the government is becoming bankrupt it will occur in the form of hyperinflation as the demand for government assets declines. The rate of inflation reflects the demand for money relative to resources. The government does not have a nominal funding constraint because it can print money, but it does have a very real inflation constraint that is imposed on it by the private sector’s demand for assets. As a result, its funding can become unsustainable when inflation is very. This high cost of funding will directly limit the government’s ability to issue new money. So MMT is correct that the government operates with a real resource constraint or an inflation constraint as opposed to a solvency constraint. But MMT is wrong to say that the government doesn’t fund its spending from taxes.

At a broader level the MMT concept of “funding” is a fallacy of aggregates. For instance, the government cannot run out of money, but this is true of any aggregated sector. The private sector as a whole can’t go bankrupt and the private sector can also print money and financial assets. This doesn’t mean we should create a whole new “school” of economics based on the premise that the private sector can print money and can’t go insolvent. Yes, it’s useful to understand the macroeconomic constraint of aggregated sectors, but there’s no need to misconstrue this to mean that the aggregated sectors don’t need income or don’t have a fiscal constraint.

It’s one thing to say the government doesn’t need to fund spending $ for $ or that the government can deficit spend without tax revenue. But it’s entirely wrong to say taxes don’t fund spending. The government absolutely relies on private sector wealth/income therefore taxes play an essential role in funding the sustainability of the government’s balance sheet. MMT wants people to think that the government does not rely on getting money to spend money because it can print money. No, it absolutely relies on taxable income to spend because that taxable income comes from the wealth and resources that make government spending viable in the first place.

The idea that “taxes don’t fund spending” is a core operational description within MMT. And they often promote this narrative by creating a fictional consolidation of the Central Bank and Treasury. But even with the fictional consolidation the narrative is still wrong as the government relies on its private sector to create value that the government can then tax and redistribute. The idea that taxes don’t fund spending is empirically wrong and no amount of mental gymnastics with the reserve settlement process can change that.

MMTers like to respond to this sort of comment talking about the way the Treasury General Account is structured inside the Federal Reserve system and how you could theoretically consolidate those accounts and that this means taxes “destroy” money since the government is receiving its own liability within the TGA. They often cite an old Kelton paper that discusses the consolidation concept and how taxes cannot “finance” government spending. But this paper is a 30 page way of saying “the government has a printing press”. Aside from being a literal misrepresentation of how the current system is structured, what this paper completely ignores is the way that the private sector creates assets that give the government spending power via taxation. The way this is “financed” in the TGA is 100% irrelevant to the fact that the government relies on its private sector to create wealth that it can tax and redistribute.

More specifically, the MMT TGA consolidation is one of many messy accounting tricks based on a misrepresentation of the reserve system and it can be easily debunked. For instance, if I borrow $100 a private bank creates a $100 deposit and $100 loan. If I use that $100 to build a corporation that is valued at $500 then the government has new wealth it can tax that wouldn’t otherwise exist. My wealth creation has directly funded the government by giving them the ability to tax me. If the govt were to tax $20 of this wealth the government would debit a bank deposit and credit the TGA. My taxes are paid in deposits and I literally cannot even pay in “state money” like reserves. The $20 of taxes is funded by your wealth creation and it is “financed” by the bank deposit which you credit to the government. The government has more spending capacity than it otherwise would because it can now tax my pre-existing wealth and redistribute it. Without my wealth tax the government would have to print new money and potentially create inflation. The fact that this payment settles in the TGA via reserves is irrelevant to these facts and doesn’t change the reality that you funded and financed the government via private asset creation. There was no need for the government to spend a single dollar into the economy to allow this all to happen.

Since MMT advocates like to talk about hypothetical alternative banking systems it’s useful to think about reserves in the proper context here because they only exist because we have so many private banks that need interbank payment clearing. But consider a system where there was only one bank within a consolidated Treasury system. You would have no need for reserves or the Central Bank and this one bank would issue all the loans/deposits to the system. If this was a private bank the US government would be a user of this bank’s deposits in much the same way that the old TT&L accounts operated. This bank would create and finance all loans and taxes would be a clear redistribution of this bank’s deposits. In fact, the current system isn’t much different. It just has more than one bank requiring the Central Bank to provide interbank clearing.

Importantly, bank liabilities do not initiate with the government and therefore cannot be “destroyed” by the government. This liability MUST be reissued back into the banking system in the future because it was created by the banking system. It is a very specific series of debits and credits that starts in the private sector banking system. But in the MMT world it is described to look as if the initial credit creation starts with the government. Depicting this as “destruction” and “creation” of money via government spending and taxes is enormously misleading as it takes money that was created in the banking system and depicts it as money that was created by government spending. This again, is another rather basic error in the specific flow of funds at work here. The entire reserve system exists to facilitate the bank deposit system by creating a two tiered money system in which banks can settle interbank payments via reserves. Deposits quite literally precede reserves, but in the MMT world they misconstrue this to make it appear as though reserves come before deposits. This is precisely backwards and misrepresents the role of reserves and the flow of funds, which specifically starts with deposit creation and is followed by reserve creation.

Using our example above – if MicroSoft is created and valued at $100 based on the market value of its stock then the government can tax and redistribute $20 of that value creation without creating inflation because the assets are already supported by existing resource value. It does not matter at all how this funding settles in the interbank market of reserves. The fact is that the value was created outside of the government, taxed by the government and then the government redistributed it back into the private sector where it came from. If Economy 1 above tried to just spend $20 they could do so by printing $20 (because their citizens don’t create anything and instead sit on the beach all day), but all this would do is cause inflation. The interbank settlement narrative makes zero difference in this and MMT has concocted little more than a clever sounding narrative that actually makes no sense when you dig into the flow of funds and initial funding source. And all of this was “financed” without the government. We created MSFT wealth and it was financed in the private banking system. The government needs to tax that wealth creation in order to be able to spend without having to print new money.

The purpose of this narrative is to create a world view in which the flow of funds always starts with the government. But this is misleading because banks can create loans independent of government and most of the value creation in the economy is done so within the private sector. When banks make loans they create deposits and obtain reserves as required after the fact. The reserve settlement process is nothing more than a back office clearing process that occurs AFTER loans are created. But in the MMT world all government spending is depicted as having created reserves and deposits, when, in reality the exact opposite is often true. But again, none of the settlement technicalities change the fact that the government funds its spending, in part, by taxing endogenous private sector asset creation.

MMT types don’t like to talk about the fact that banks issue currency equivalent forms of money because that ruins their view that the State Theory of Money perfectly applies to the USA. It also ruins the whole “currency issuer” narrative because the banking system issues a currency equivalent that can be used to fund government spending. At this point they’ll say banks are “agents of the government” or something like that while ignoring that banks are very much private entities who work for their shareholders. Using their thinking you could argue that the govt is the monopolist of everything. Oh, the government sets the measuring system in a country so now they’re the monopoly supplier of measuring tapes. Dewalt isn’t a tool company, they’re really an “agent of the state”. Why stop there? Every corporation in the USA has to obtain a charter to operate. By this logic we might as well call every corporation an “agent of the state”. It’s all so warped and basic common sense brings some balance back to a wholly unbalanced MMT view.

Perhaps the best way to see how badly MMT advocates misunderstand all of this is to look at their advocacy of 0% interest rates. MMTers think we reside in a state money system and so they believe that we don’t need to issue bonds and pay interest on bonds. They’d have us all believe that the system is structured the way it is because the people running it don’t understand it and only the MMT gurus can save us all from this misunderstanding. Except it’s the MMT people who don’t understand that banks are equally important issuers of money. Yes, they understand endogenous money, but somehow fail to understand that issuing duration based bonds and paying interest is an important inflation control mechanism. Because the government has outsourced most of the money creation in the economy it has to use other indirect tools to control the amount of money banks might issue. For example, during Covid the government printed trillions of dollars and interest rates were at 0%. Since most loan/deposit creation is tied to housing this was especially dangerous as the large deficits drove huge demand for housing and caused housing prices to surge. As inflation surged the Federal Reserve needed to raise interest rates to slow loan growth, especially in housing. As they raised rates they crushed mortgage affordability and bank loan growth slowed. Inflation subsequently fell. The main reason this works is because the interest payments reduce loan demand and increase the demand for money from wealthy investors who rebalance their portfolios increasingly to these higher interest bearing instruments. MMT flat out misunderstood this and would have had us keep rates at 0% even while inflation was roaring. This is a dangerous misunderstanding of how the system works.

Whenever someone points out the importance of independent bank issued money MMTers say something about how banks only issue “IOUs” for government money while ignoring the fact that it is literally impossible to banks to even give you reserve deposits or convert all deposits to cash. In reality, the US government has outsourced money creation to the banking system which allows the banking system to finance government spending. Arguing with an MMTer is like a game of whack-a-mole where they flip from bad argument to bad argument.

This is all a distraction from the broader point at hand. It does not matter at all if this is all funded via banks or the government. Even if the banking system were fully nationalized and all “money” was a state liability the government would still rely on the private sector to be able to spend. This is because the government does not create most of the assets that are ultimately taxed. Therefore, the government would still rely on the private sector to create the valuable assets that can then be monetized and taxed. In other words, even with a fully state money system the government would still rely on the private sector to create the resources that make government spending viable in the first place.

Of course, deficit spending does indeed create new money and financial assets and government spending can potentially be “self funding” if it mobilizes resources and creates real value. So it isn’t an either/or story. Taxes can both fund the government’s spending by redistributing value that already exists AND government deficits can create new money (and new value). It isn’t an either/or process despite MMT framing it all as only starting with the government. This is again a case of overreach in describing the system and results in an unbalanced and unrealistic understanding of the actual flow of funds in the system.1

When confronted with the obvious reality that private sector resource creation funds the government MMTers will try to dismiss this and argue that taxes only exist to “drive money”. This is nonsense as well. Taxes may play a role in generating demand for a currency, but we know for a fact that taxes are not needed for money to become widely accepted because monetary units like Bitcoin would be worthless since they have no tax. Ironically, using this logic, MMTers predicted in 2013, when Bitcoin was at $1,000 (currently at $60,000 as of 2024) that it was worth $0.

The “taxes drive money” narrative is one of the truly inane narratives in MMT. They construct this narrative to make it look like the state drives demand for money by issuing money and imposing taxes. They usually depict this with an insane example of a man in a room handing out business cards and threatening to kill you if you don’t use the cards. As if we live in some sort of authoritarian regime where we can only do things the state allows us to do. Aside from the fact that the government doesn’t even need to issue money (because banks can do it), we use money because we want resources and certain forms of money attain a network effect due to embedded trust. The government can certainly contribute to establishing this trust, but it’s not necessary. And taxes play no role in any of this. It’s as silly as saying that there’s demand for bank deposits because the bank charges you a tax (interest) on the loans. No, people want deposits because they’re a trustworthy monetary unit that gives us access to goods and services. It has nothing to do with the fact that the bank charges you a fee.

1 – Not to get overly wonky with this topic, but much of this is a net present valuation assumption. MMT implicitly assumes that there is existing excess capacity or that government spending has a positive net present value which will create value that makes their spending inflation neutral. And it’s certainly true that government spending can have a positive NPV. But it’s also true that most government spending has a negative NPV because most government spending is in areas that the private sector cannot or will not invest in. Things like war, putting out fires, operating a police force, etc are not profitable endeavors for the most part and so the private sector will tend not to engage in these things because they are not well suited for profit driven entities. The aggregated private sector, on the other hand, tends to be better at generating +NPV projects because of its natural state of competition and creative destruction. So we shouldn’t paint with too broad of a brush here. Ina general sense the government absolutely relies on obtaining funding from the private sector, but it can also be self funding when its spending has a +NPV.

5) MMT plays A LOT of word games.

MMT has created a whole new taxonomy for their version of economics. When you first come across MMT it will sound like an entirely new paradigm because they speak their own economic language, but as you translate many of these terms you slowly realize that a lot of what they’re doing is just saying well known concepts in different (often times misleading) ways. Many of these terms are used in such a loose manner that they can have multiple meanings and even changing meanings. It’s so bad that Paul Krugman has referred to the whole theory as a game of Calvinball, the Calvin and Hobbes game in which they change the rules as the game goes on.

The worst abuse of language in MMT is the way they depict well known accounting concepts in economics and change the definitions to mean something else. The most egregious misuse of accounting is the way MMT redefines private sector net saving as saving net of investment in an effort to argue that the government “must be in deficit” or by saying comments like “absent…government deficit, the domestic private sector cannot net save“. They even go so far as to say “If the government always runs a balanced budget, with its spending always equal to its tax revenue, the private sector’s net financial wealth will be zero.” Or saying things like “the national debt is the equity that supports the entire [economy].” This is all incoherent. The national debt is not equity. Debt cannot be equity and it’s hard to imagine that a professional economist would even imply that printing money is the equivalent of printing equity. This fails common sense 101, accounting 101 and macroeconomics 101.

This confusion is intentional and necessary because MMT is incoherent and inconsistent on these matters. It can be no other way because the entire theory has so many internal inconsistencies across their various sloppy generalizations. In this case they intentionally depict the economy as being just two sectors (private vs public) and then throwing around an accounting tautology like (S-I)=(G-T) to validate this claim. This is misleading as it makes it look like the private sector can only save if the government deficit spends (when in fact we mostly save intra-sector within the private sector). This is often communicated with an accounting tautology such as “their red ink is our black in” as if to imply that government deficits are always a good thing (because, in the MMT world that’s where private saving comes from). This is usually depicted using a two sector chart of the economy and if you aren’t well versed in accounting and economics it will sound perfectly accurate.

Reality is much more complex than this two sector depiction. A proper accounting of this requires a much more granular view (as described here). Describing private sector net saving as being equal to (S-I) is implicitly assuming that I=0 when in fact, corporate investment is one of the main drivers of S and the value creation and innovation of that investment spending is the main driver behind demand for money in the first place. Depicting private sector net saving where I=0 is simply absurd and nets out the absolute most important component that adds to private sector saving(s).

More specifically, it is misleading to depict all of this in a 2 sector view (private vs public) where we define “net saving” in such a narrow sense that the reader comes away thinking that the government “must” be in deficit, when, in reality, there is absolutely no need for the government to be in deficit in order for the private sector to accumulate net savings on its own. In reality, a more granular view would breakdown the private sector into its many various sectors (households, corporations, non-corporations, etc) to show how these entities save relative to one another. The private sector isn’t a homogeneous sector and it can net save against many other sectors and entities, of which the government is only one. This is one of many terminological issues wherein MMT uses the term “private sector” to create the appearance that every entity outside of the government is homogeneous, when, in fact, they are structured in very specifically separate manners for very specific economic purposes.

The most important relationship of these is the household sector versus other households and everything else. The household sector net saves in numerous types of financial assets relative to other households, the corporate sector, foreign sector, financial sector and government sector. But the government is just one sector from which the household sector can net save. And there is, emphatically, absolutely, positively no need for the government to spend a single dime to allow the household sector to net save against other sectors. Saying the government “must be in deficit” is not just misleading, it is wrong in a very basic sense. And in fact, the corporate sector is the most important issuer of net financial assets as they are the firms that invest and produce most of the things that make money valuable in the first place. This is clear to anyone who has a retirement plan and owns stocks or bonds as the value of their savings is contingent on how well the corporate sector invests and creates value. The US stock and bond markets are worth over $100 trillion as of 2023. This comprises the vast majority of private sector savings and corporate investment can add to aggregate savings without households having to dissave. But in the MMT world none of this really matters because it all “cancels out” in their consolidated private sector view. They would look at someone like Bill Gates who owns a large portion of Microsoft and say that Bill and Microsoft have no net financial assets because their consolidated net worth is comprised largely of the corporate assets that his own company owes him. This is preposterous as these assets reflect the value of the most important cash flows in the entire economy as they represent the things we innovate, produce, consume and invest in. Any theory that consolidates households into corporations and then claims they aren’t creating aggregate savings is misconstruing the very purpose of these disaggregated entities.

The MMT view is like understanding that there are no net financial assets on Earth in the aggregate because all assets have corresponding liabilities and then arguing that Earth must receive “net financial assets” from Martians in order to “net save” against the rest of the universe. This is a nonsensical two sector view of the universe because even MMT advocates know that Earthlings can “net save” against their own government, with or without Martian net liability issuance. But MMT makes the same misleading accounting narrative when discussing government deficits in the context of net saving on Earth. We should be blunt about this – it’s an extremely narrow and misleading depiction of the way households and the private sector, more broadly, net save.

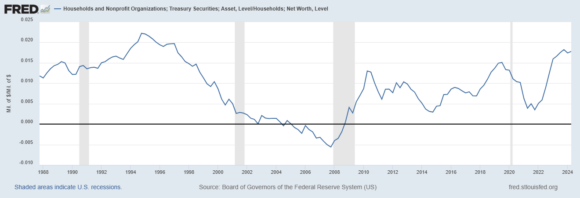

To put this into context it can be helpful to look at actual household net worth. MMT frames the deficit as the “equity” that supports the entire economy. But most government debt isn’t even held by the domestic household sector. It is mostly owned by the government and foreign governments. Household net worth is comprised of just 1.8% government bonds as of 2024. The overwhelming majority of household net worth is comprised of domestic investment in things such as corporations or private investment. But MMT nets out investment in their framing of this and tries to misconstrue the government’s liabilities as the key component of domestic saving(s). Aside from failing accounting 101 it is just a preposterous framing of how a Capitalist economy accumulates savings.

Perhaps a better example is corporate structure. Corporations have shareholders whose assets are directly impacted by the actions of the corporation. The individual shareholders do not hold the liabilities of the corporation, but they are directly impacted by the actions of the corporation and the liabilities it incurs. The government is no different. The liabilities the government incurs impact all of the citizens through inflation and taxes. We are all liable for their actions and their liabilities even though we do not individually hold their liabilities. But MMT wants us all to think that we’re not liable for any of this because we don’t hold the individual government liabilities on our personal balance sheets. This is not just an incomplete depiction of how the economy and government works. It is fundamentally wrong.

The idea that all net financial wealth comes from the government is especially misleading. And once again, there’s no kind way of saying this – it’s based on an extraordinary misunderstanding of how financial wealth is actually created. In reality government money printing just creates money, not real financial wealth. That money is an asset for the aggregated domestic economy and a liability for the aggregated domestic economy. Whether that money is used to create real wealth depends on many factors. This doesn’t mean it cannot create real wealth, but the idea that the money printing necessarily creates real wealth is like assuming that a fund raise by a start-up firm necessarily creates shareholder equity for the company. No, it depends on how the firm invests the money and whether they mobilize resources into more valuable resources. This feeds into the broader misunderstanding in MMT where money creation, all else equal, would just create inflation. If the money is used for investment spending it can create wealth in both nominal and real terms. But the assumption that nominal money creation creates real wealth is just untrue and that is ultimately what matters most for the domestic economy. And in reality our net financial wealth is largely contingent on how well households and firms invest and contribute to the value of our real stock of savings in things like houses, corporate valuations, etc.

Of course, you’ll never hear MMT advocates admit any of this because then they’d also have to admit that:

- We don’t have a state money system, we have a predominantly bank money system. The government is not the “monopoly supplier” of money.

- Government deficits add to corporate profits and can create inequality.

- The state relies on the value creation of corporations and households to fund spending.

- Households and corporations do not rely on the government to access net saving(s).

- The government relies on the household and corporate sectors to innovate and produce so that the money printing of the government doesn’t cause excess inflation.

Further, MMT redefines full employment to mean zero involuntary unemployment (while most economists define it as optimal employment). This is convenient for MMT because they promote a Job Guarantee so, until there is a Job Guarantee they will always view the economy as operating at a sub-optimal level of employment. The extreme (and unsupported) assumption here is that a Job Guarantee IS optimal employment. So, in the MMT paradigm the definition completely shifts based on the assumption that giving everyone a government job is the equivalent of optimal employment. This view is wholly unsupported by empirical evidence.

They also use the term “sovereign currency issuer” in a manner that is nearly useless since they can’t define when a country is sovereign or not or how various economic environments might reduce or even eliminate sovereignty. They use this term in a hand-wavy sort of fashion to dismiss anyone who says MMT might or might not apply to a certain country. This term is like going around saying “wealthy” people are financially free without providing the actual parameters defining financial freedom.

The truth is that sovereignty exists on a spectrum and no country is fully sovereign. The nature of financial markets involves counterparty risk and a degree of reliance on others to achieve certain things. The government relies on the non government to mobilize the resources that make its spending viable. The household sector relies on the corporate sector to achieve certain outcomes. The corporate sector relies on the government to regulate. So on and so forth. No country or sector is fully sovereign and so no government can operate with absolute control over its domestic economy because it relies too heavily on counterparties to achieve its goals.

The way MMT talks about “sovereign currency” issuers makes it seem like any country can just choose to be sovereign. In reality many countries cannot choose to be sovereign and rely on the kindness of strangers to provide them with goods and services that they don’t produce domestically. Most emerging markets have this problem and rely on foreign debts and foreign investment to help them grow. They cannot simply choose to be sovereign any more so than a poor person can just choose to be rich. But in the MMT world the government just needs to spend and they’ll magically grow into a large developed and wealthy economy. This is, frankly, a naive treatment of balance of payments constraints.

They do something similar in their use of the term “resources” often talking about how “resources constrain spending”. The implication is a vague constraint on government spending that is hard to pin down. MMT advocates do not and cannot quantify this constraint. They also intentionally neglect to mention that the private sector creates resources endogenously and therefore helps fund the government in doing so. All of this is part of a theory of inflation that is unquantified and based on vague generalizations.

All of this slippery jargon makes for an interesting general conversation, but creates confusion when you get into the important details. More importantly, it is outright misleading in many specific cases.

6) MMT has an excessively state-centric view of the world.

The entire theory can be summarized as “the government has a printing press and it should use this power to offer everyone a job”. I don’t necessarily think this is wrong. There are good reasons why the government might WANT to spend money or provide jobs. But MMT tortures and twists reality to try to make a coherent economic argument for why the government “MUST” do these things. The theory is really just a political agenda masquerading as an accurate description of the monetary system. In reality their description is largely theoretical and empirically wrong in numerous ways. And their policy ideas are unsupported by empirical evidence and core ideas like the Job Guarantee have never even been tried in developed world economies. Despite this they promote themselves as revolutionaries and even go so far as to claim they’re the Copernicus of modern day economics. In reality they are more like astrologists promoting a harebrained theory that is only accurate in the most generalized sense.

The entire world view of MMT starts with the state and focuses excessively on the state’s powers. In the MMT world all money creation starts with the state. Unemployment is caused by the state. Net financial assets can only be provided by the state. All of this is vaguely correct, but precisely wrong and the excessive focus on the state results in a wholly unbalanced view of what makes the economy function. In reality the private sector operates as the central source of money, financial assets, investment, consumption and saving, but in the MMT much of this is flipped around where the government is the centerpiece of the economy and the private sector is subservient to the government waiting for it to provide things like jobs, savings and money.

The reality is that the public sector vs private sector relationship is a symbiotic one with the state operating primarily as a facilitating feature, not the driving force. It isn’t an either/or and MMT too often constructs their narrative in such a way that makes it appear as though we’re all entirely dependent on government to do certain things. In truth, there is no “must” in any of this. The government doesn’t need to spend money or offer everyone jobs or distribute net financial savings. It might be good for the government to do some or all of these things, but there is no “must”. But in the MMT framing you come away thinking there is no alternative because they’ve framed everything in such a state centric extreme view. In many cases it’s simply overreaching and turning “should” or “could” into “must”.

7) MMT tries to claim they are describing reality when they’re really describing an alternative reality.

MMTers sometimes claim that they’re just describing how things work. But MMT is actually based on two conflicting views of the financial system – what they refer to as the “general” and “specific” view. The general view is a vague overview of how things work. The specific view is how they try to mesh this vague general view with the actual reality of the monetary system. For instance, in the general view the government spends first and taxes second. But in the specific view the government is required to obtain bank deposits when it taxes and clears them with reserves to spend. They try to reconcile these two conflicting narratives by creating a fictional consolidation of the Fed and Treasury, but fail to account for the fact that existing institutional arrangements conflict with MMT’s general narrative. Specifically, the existing system is designed primarily around private competitive banks that create most of the money, but in the MMT world it’s not the banks that create the money “first”, but the government that “spends first”. This is completely contradicted by the actual structure of the existing system and misconstrues the purpose of banks and the Central Bank within this system.

MMTers will try to separate their descriptive aspects of the theory from the prescriptive, but the truth is that they’re directly intertwined. For instance, as we describe below, MMT describes the currency as a state monopoly and that the state causes everyone to be unemployed unless they provide that currency to be used for taxes. They then conclude that the only solution to unemployment is therefore a Job Guarantee program because they claim the government is the only entity that can solve the problem that the currency monopolist creates. This “description” is highly theoretical and misleading in specific ways which we discuss in detail below. But the important point is it explicitly ties into their prescriptions. There is no distinction between the description and the prescription because if you buy into their description then there is no choice but to buy into the prescription.

MMT’s core operational descriptions are also highly theoretical. For example, the theory claims that taxes don’t fund spending and that the government must actually issue currency before it can even tax. MMT founder Bill Mitchell says:

To understand the causality – start of at Day 1 of a new monetary system. How do the private sector pay their taxes or buy government bonds in the new currency which they do not issue? The answer is incredibly simple. The government has to spend first and put the currency into the hands of the non-government sector.

This is not necessarily true. The government can spend first by printing money, but it could also tax deposits created in the banking system before it spends. The correct statement is that the government must assign a unit of account first, but there is absolutely no need for it to spend before it can tax. In reality most taxes are paid using bank deposits and then settle in the interbank system after the fact. But in the MMT world the Fed and Treasury are consolidated and banks are positioned as “agents of the government” so it’s all distorted to give the appearance that government spends first.

This is an important flaw in the MMT framework as it confuses the roles of monetary policy and fiscal policy by consolidating them into the same thing when in fact they exist for distinctly different reasons. We have specific government entities for specific reasons. And we break up their accounting and assets and liabilities to show exactly what the role of those financial instruments are. For example, the Fed holds trillions of dollars of MBS and T-Bonds due to QE. The Fed quantifies them daily and accounts for them meticulously. They aren’t “destroyed” in any reasonable economic view and those assets have real world economic impacts. The Fed pays employees and operates their interbank clearing system, in part, by using the revenue from their balance sheet. Do the MMT people really believe this money isn’t there? Do they think it’s all a fiction just because the Fed has received a government liability? That would be misleading, but in the real world we precisely quantify those assets because they are real assets that have material economic impacts for real people. They aren’t just “destroyed” because some economic theory treats them as arbitrarily consolidated assets.

More specifically, reserves exist because the current private clearing system requires interbank deposit settlement. Deposits, by definition, must precede reserves. But in the MMT world this is all backwards and reserves reflect government money creation in the first instance, when, in reality, reserves only exist because the Central Bank expands their balance sheet to facilitate the movement of existing financial assets (mainly deposits).

This confusion is why we often see MMT consolidate the Fed into the Treasury. In reality the Fed and Treasury are separate entities serving specific purposes. The Fed operates as the bank for banks as well as the bank for the Treasury. You cannot consolidate the Federal Reserve into the Treasury and also tell people that you’re describing reality. No, they are consolidating entities to spread overly simplistic generalizations that confuse how and why these institutions operate. Any theory that relies on consolidating the Fed and Treasury is not describing reality. They are specifically distorting reality to spread a false narrative based on a misrepresentation of the actual monetary system.

In reality, the Central Bank exists specifically because most modern economies do not have State Money, but have money systems developed around private banks. The US government has outsourced much of its money creation to private for profit entities and banks can create money entirely independent of the government’s spending and taxing. It’s especially strange to misconstrue this because the USA is very specifically a capitalist country that relies on the competitive nature of its money and resource creation. Our financial system is the largest and most efficient in the world in part because it’s highly competitive. That’s the nature of private banking. But MMT misconstrues this to make it appear more like a nationalized state money system. Nothing could be further from the truth.

Consolidating the Fed and Treasury can be useful for theoretical purposes, but in the actual system the Fed and Treasury exist for specific reasons that MMT ignores. What MMT does with this consolidation and “destruction” of money concept is incredibly misleading and downright wrong. It creates the illusion that all money creation starts with the state, but in reality banks create money and the state uses the reserve system to redistribute bank money. The reserve system only exists because we have private banks, but MMT portrays the reserve system to make it look like reserve clearing creates all money. The MMT portrayal of this misrepresents the entire purpose of the reserve system.

For example, if a bank creates a deposit and you pay your taxes with that deposit then the government uses reserves to clear the payment. Again, the reserves only exist because we have a bank based monetary system that uses interbank clearing in the reserve system. If I borrow $100 to build a company and the government taxes $20 then I submit my taxes with deposits. My bank will then credit $20 to the TGA by debiting their reserve account. This adds $20 of settlement balances to the TGA and when the government spends $20 they will credit a bank with $20 of reserves which will result in a $20 deposit credit to someone else. This flow of funds started with the private banking system and resulted in nothing more than a redistribution of those deposits back into the deposit system. But in the MMT world the taxes are misconstrued and presented as having been “destroyed” when the Fed credits the TGA with reserves and then they call it new money creation when the government spends. This is truly bonkers. The money creation process very clearly started with a bank and the reserves only exist to settle the bank payment, but in the delusional MMT world the money creation started with the government. This is completely backwards!

These various “consolidations” are part of how MMT misconstrues the inner workings of the monetary system when they explain how things work. They consolidate the Fed into the Treasury to give the appearance that taxes don’t fund spending. And they consolidate households into corporations when they discuss how the private sector can only “net save” by obtaining public sector assets. This is all interesting as tautological macroeconomic generalizations, but it’s very misleading at a precise microeconomic level and the microeconomic level is where the important operational understandings exist.

MMT likes to invoke the “State Theory of Money” to promote the theory and argue that this accurately describes the current monetary system, but the reality is that we don’t have state money. We reside in a system with bank controlled money as the US government has outsourced money creation to private profit seeking banks who create money when they create loans. The entire system is structured around banks and the Federal Reserve system exists specifically to service these banks. We don’t bailout banks once every few years just for fun. We bail them out because the entire system is dependent on their health. But rather than portraying this as a Bank Theory of Money, MMT twists reality to argue that banks just create “IOUs” denominated in Dollars and that we really have a state money system. Nothing could be further from the truth and it’s baffling that MMT advocates hide this because they are, at heart, Statists who should fully embrace a fully state based money system with nationalized banking. I can only presume they don’t embrace this because they know it would never be popular in countries like the USA.

MMT also relies on assuming that a country is “sovereign” (despite not knowing what exactly that means) in the first instance. This is why MMT is applicable only to developed world countries and cannot be usefully implemented in undeveloped countries that don’t have the resources to support large public purpose spending programs like Job Guarantees.

Further, MMT is based on several controversial claims such as the idea that the government causes unemployment by creating the monetary system. This is not merely an operational description. This is a controversial description that is central to how their world view is constructed. MMT is a buffer stock of employment theory of economics. All modern developed economies are buffer stock of unemployment economies. MMT is an entirely different approach to economics based on controversial underlying theoretical claims. You cannot claim to be describing reality when MMT is based on an entirely different paradigm that has never even been attempted in developed economies.

This leads to much confusion among MMT’s advocates who often claim that MMT has a “descriptive” and “prescriptive” component when, in reality, the description and prescription are explicitly intertwined. As Bill Mitchell stated in 2011:

The reality is that the JG is a central aspect of MMT because it is much more than a job creation program. It is an essential aspect of the MMT framework for full employment and price stability.

You cannot separate the prescription from the description because the description specifically leads to the prescription conclusion. If the government, as monopoly supplier of money, causes all unemployment by not supplying sufficient net savings then the government is the only entity that can fix this. There is no separating the two. Of course, the description is theoretical and wrong, but in the MMT world they frame this in an inaccurate manner in which it appears correct.

More importantly, no government or economy runs a full MMT style regime with a consolidated Central Bank and Treasury managing a large scale Job Guarantee. This is important because MMT really boils down to a Job Guarantee. As Mitchell stated, it’s the essential aspect of the framework, but no country does this. So no, MMT does not describe the monetary system correctly and the current system is not similar to what a MMT style system would look like with a large scale Job Guarantee.

8) MMTers Misconstrue Institutional Relationships.

MMTers would fit under the Post-Keynesian tent as Institutionalists. That is, they focus heavily on institutions, accounting and the inter-sector relationships between those institutions. Their treatment of various institutions is at odds in the “general” and “specific” views. In the specific view, that is, the actual view, the reserve system is little more than a clearinghouse for bank reserves – reserves exist specifically to transfer non-government liabilities to the government. And since private banks create most of the money in the system a public clearinghouse is helpful for interbank payment clearing. MMT advocates consolidate the Fed into the Treasury which misconstrues the fact that the Fed exists for a specific reason – because we have private banks that need interbank clearing and the government spends in part by redistributing these non-government liabilities.

Importantly, this contradicts the flow of funds in the MMT narrative. Instead of government spending appearing like money creation it now becomes clear that most government taxing and spending is just a redistribution of existing bank deposits because most money is created independent of the government and the Fed operates as the clearing entity for deposit transfers. The specific view contradicts many of the narratives espoused in the general view.3

For example, if a bank creates a $100 loan then this will create a $100 deposit. If there is a 10% reserve requirement then the loan will also require the Fed to create $10 of reserves. In other words, the loan creates deposits and also creates reserves, but those reserves come after the deposit. If the government decides to spend $1 by taxing $1 then the taxpayer’s payment is cleared when their bank debits $1 of deposits. The bank then credits $1 of existing reserves to the Treasury’s account at the Fed. When the government spends this $1 the bank is credited with $1 of reserves and the recipient is simultaneously credited with $1 of deposits. The balance sheets, in aggregate, did not expand at all because of government spending or lending operations. They only expanded because of the original loan creation. MMT presents this as though the flow of funds started with the government instead of the bank. This is totally incoherent and misconstrues everything about how modern banking really operates.

Further, all of the spending and asset flows are tracked in real-time by the Federal Government. MMTers like to say that taxes destroy money, but you can literally see the money, in its actual accounts whenever you want to. The TGA balance, for instance, is right here. Or you can look at the Treasury Daily Statement where they show the actual flow of funds into and out of the TGA on a daily basis. Or you can look at the Fed’s balance sheet right here. It’s a meticulous and simple flow of funds accounting that shows the balances to the dollar. These dollars aren’t just fictional accounting entries. They were not destroyed at all. They have specific economic ramifications and the credits/debits help fund specific parts of our government. Clearly, nothing has been destroyed here unless you misconstrue the institutional relationships to reflect something they don’t. But in the MMT world these accounts don’t really have money because the consolidated government supposedly holds its own assets where the assets get “destroyed”. This is a nonsensical view of the world as these specific balance sheets serve specific economic purposes that have real-world impacts. They aren’t “destroyed” in any meaningful sense and any theory claiming such things is not based in reality.4

MMTers sometimes try to prove this “destruction” concept using historical monetary units like ancient Talley sticks. Talley sticks were used in ancient authoritarian Monarchies. They have zero bearing on how a free market capitalist economy operates. Of course, this isn’t surprising coming from MMTers because they’re mostly Statists who think that authoritarian economies are good. It’s ironic that they promote MMT in countries like the USA where the whole source of government funding comes largely from private capital formation in the most Capitalist economy that has existed in human history.

9) The Job Guarantee is a virtually unproven program.

A central operational error in MMT is the idea that the government causes unemployment and must therefore fix it. The basic thinking is that the government introduces a currency and requires people to obtain it via a tax. If you can’t obtain it then you are unemployed. The problem with this theory is that it assumes the government is the only entity that creates money when in reality the private sector creates many different forms of money (primarily bank deposits via bank lending). The actual cause of unemployment in any economy is a lack of investment and sufficient savings/income that is properly distributed to drive sufficient demand. The government does not necessarily have to create a single dollar in order for there to be sufficient demand, savings or employment.

This error leads MMT advocates to promote a Job Guarantee since they arrive at the conclusion that the government must fix unemployment since they (supposedly) caused it. In addition to saying this program can provide “full employment” they also claim this program can provide price stability. This is a claim that is wholly unfounded, supported by virtually zero empirical and real world evidence and one I have always been skeptical of. It’s not that I think it’s necessarily wrong. It’s more so that the evidence supporting these claims is thin at best and what little evidence we do have does not support MMT’s bold claims.

A JG has never been tried in any developed economy and it has only been tried a handful of times in developing economies – India and Argentina. In the case of India the program has been halted at times after accusations of government corruption. Surjit Bhalla, one of India’s leading economists has described the program as a “horrendous failure” and one of the most corrupt programs in the entire world. India’s Finance Minister, Nirmala Sitharaman, says the program has been “infested” with ghost accounts and corruption.

In the case of Argentina the evidence was inconclusive, but inflation averaged 15% in the 5 years following the program and the program was subsequently terminated. There is considerable debate about whether the program was good or bad, but what’s clear is that it did not produce price stability or full employment in perpetuity.

It’s rather alarming that the central component of MMT is a theoretical policy idea that is based on a vaguely accurate description of the government as a currency monopolist. But what’s more alarming is the manner in which MMT advocates confidently promote this idea despite there being almost no evidence to support its efficacy. Given that this is the core component of MMT and a potentially economy altering policy approach, it would be nice to see more evidence to support the theory. Until then the often combative and overly confident tone of MMT advocates is unwarranted.

Read more about the Job Guarantee here.

10) MMT doesn’t have a proven theory of inflation.

MMT says that the government has no nominal spending constraint and instead has a real resource constraint. This is an incomplete view on this because reality is more complex than this simple binary distinction. In reality a real resource constraint imposes a financial constraint on a government. For example, a country with very high inflation will be forced to constrain its nominal asset issuance because further asset issuance could create higher inflation.

Saying the currency issuer has no nominal inflation constraint is true in theory and false in reality because the inflation is indicative of collapsing demand for the currency. In other words, inflation is just a price signal whereby demand for real resources is increasing relative to demand for money. The private sector is setting the real price of the currency and imposing constraint on the government via demand for its assets, but MMT depicts this as though the government is the real price setter. A very high rate of inflation will force the government to reduce its nominal financial asset issuance in order to bolster demand for money. So a real resource constraint becomes a nominal financial constraint when inflation is high. MMT appears to misunderstand this and makes an overly simplified binary distinction that is only right in theory and is dangerously wrong in reality.

Saying the government is a monopoly issuer of currency with no nominal issuance constraint is as silly as saying a corporation is a monopoly issuer of its common stock with no nominal issuance constraint. Yes, in theory the corporation can issue infinite amounts of stock, but the value of that stock is set by demand relative to supply. If the corporation issues too much stock the market will reprice the shares and impose financial constraint on the firm despite its ability to issue infinite stock in theory. The same principle applies to government currency issuance and high inflation is little more than a price signal that imposes nominal asset issuance constraints on the issuer.

One thing that gives many economists pause about MMT is that it isn’t just a standard countercylical Monetarist or Keynesian economic theory. MMT is an inherently procyclical economic theory with sustained deficits and sustained full employment. There is no countercyclical inflation fighting mechanism as seen in all traditional schools of economics. The problem is this perpetual procyclical policy response has no empirically supported inflation controlling mechanism. It has never been attempted or successfully achieved in a controlled inflation environment.

As I’ve written before, there are several empirical flaws in MMT’s approach to inflation. This includes:

– A Job Guarantee acting as a price buoy and not a price anchor.

– Discretionary tax changes as an imprecise and inefficient inflation control tool.

– Price controls as a flawed inflation control tool.

– A broad rejection of Monetary Policy despite ample evidence of its efficacy controlling high inflation.

MMT people often say that a sovereign currency issuer has a real resource constraint. But they never model what this means and the terms are intentionally vague to the point of being useless. When is a government “sovereign” exactly? And how do we model “real resources”? When does all of this actually create inflation?2

It seems as though MMT is moving the debate from governments having solvency constraints to inflation constraints without actually explaining and being able to predict when the inflation constraint becomes a problem. I agree it’s useful to understand that governments don’t go bankrupt, but none of this is very useful if you can’t explain the precise parameters within which the inflation constraint is a problem.

The Ugly.

11) MMT advocates are often combative and cultish. I’ve enjoyed learning from and interacting with some MMT advocates over the years. Others are, um, more problematic. I critique a lot of things here with the goal of being constructive, but the MMT people have a uniquely combative mentality when confronted with criticism. MMTers regularly defame and attack mainstream economists by misconstruing their views in an attempt to position themselves as the only true experts about all things economics. It’s ironic given the numerous errors in MMT and their personal attacks on critics are evidence of a theory they cannot defend on merit and so instead has to be defended via ad hominems.

The theory is so delicately intertwined and lacking in empirical evidence that their proponents often get very frustrated when debating. You could actually argue that the biggest red flag in MMT is the way in which their advocates defend it without ever admitting that there could even be the slightest potential flaw in it. I’ve spent most of my life studying economic theories and there are no economic theories that don’t contain flaws.

In 2024 MMTers created a movie called “Printing The Money”. They invited numerous mainstream economists to be interviewed including the Chair of the Obama and Biden economic teams. They invited these economists under the premise that they were doing an objective movie on the national debt, but in fact they were filming a hit job promoting MMT. The movie misrepresents and distorts the views of these economists to make them appear incompetent so MMT can try to claim they’re the ones who really understand economics. Imagine how stupid you have to be to harm the reputation of your own political party and the left wing economists who are most likely to be sympathetic to your policy ideas? This charade is typical of MMT’s consistently appalling behavior. These sorts of malicious actions are the surest sign of a theory that relies on gotchas and gimmicks instead of empirical analysis.

The most disconcerting thing about MMT is that it boils down to an unproven Job Guarantee proposal promoted by people who appear to be driven by faith and politics more than evidence. MMT advocates promote the theory as though it has earned a level of credibility that it simply has not. Their brash and combative tone treats the ideas as settled science when in fact they have not been properly modeled or tested in any relevant economic setting. Perhaps one day a developed economy will test MMT in its entirety and then this confident tone will have been earned. Until then I think it’s rational and responsible for people to be skeptical of MMT’s many descriptions and claims.

Conclusion

To summarize, there are some useful elements in MMT and it can be educational to learn. At the same time, many of its most important concepts are based on vague generalizations, sloppy terminology, misleading accounting and policy ideas that are wholly unproven. It has become popular with lay people in large part because the narratives are enticing and complex enough that they can be misconstrued into something most lay people won’t understand. But most mainstream economists remain skeptical of it because parts of MMT are downright wrong, and its policy ideas have not earned the credibility that its proponents often assign to it. This is primarily due to the fact that the theorists have not done the proper econometric work to make the theory useful in a quantifiable economic model. Until the theory has been modeled and attempted in a developed economy it remains little more than an untested, but interesting mental exercise.

————————————————————————————–

Update – We mention above that MMT doesn’t have a viable evidence based theory of inflation. Part of this is their rejection of a balance of payments constraint and the rejection of traditional monetary policy as an inflation fighting tool. Recent evidence regarding these views and the 2021 high global inflation is worrisome to say the least. For instance, in Turkey the Lira has collapsed under high inflation due to a balance of payments constraint and high domestic debts. In 2005 Randall Wray is on record explicitly stating that Turkey could not have a balance of payment constraint. MMTers often claim that raising interest rates causes higher inflation. So, in 2021 MMT founder Warren Mosler recommended a 0% overnight rate to “firm the Lira”. Coincidentally, Turkey began cutting the overnight rate at this time and the Lira collapsed 50% in response in just a matter of months. A common criticism of MMT is how they’d respond to a high inflation. We now know that a lot of what they’d recommend can make matters worse.

Turkey is an important prediction here because it exposes the degree of misunderstanding across MMT. MMT misunderstood whether Turkey was “sovereign”. They sling this term around without quantifying it so it has virtually no useful meaning in MMT. In reality, no country is fully sovereign and we all rely on the kindness of strangers to some degree. In the case of Turkey they relied heavily on foreign imports and the kindness of strangers to produce what they could not produce domestically. They were heavily resource constrained which resulted in a government budget constraint due to a balance of payments constraint.

More recently, MMT has come under criticism for their response to inflation in the USA (or lack thereof). In the MMT literature they consistently endorse tax hikes to combat high inflation. Here are Mosler, Kelton and Wray all explicitly endorsing this view in their books:

“Government should raise taxes in the future (or cut other kinds of spending) only if aggregate demand is excessive at that time.”