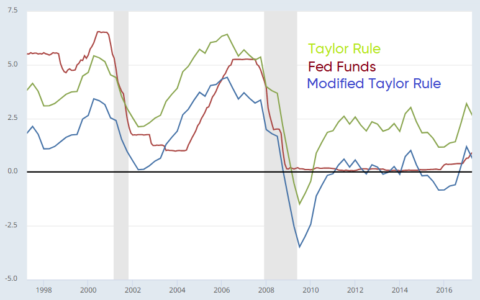

I am not a big fan of discretionary Monetary Policy, things like QE and interest rate tinkering. In my opinion these policies tend to be very blunt and reactive, often times in precisely the wrong ways as we react to data that has already impacted the economy. I believe we would be better off automating Fed policy and interest rate policy in particular. This, of course, isn’t a new idea. John Taylor, for instance, has long advocated for this approach using the Taylor Rule. The Taylor Rule is an automated approach to interest rate changes using a systematic equation that applies rate changes.

I find this approach extremely appealing, but it has a history of overreacting and lagging into recessions due to what I believe is excessive band width in the model. If Taylor dampened the width of the bands in the model the interest rate policy changes would be dampened thereby maintaining the strong proactive tendencies of his model without the potential for such extreme overreactions. For instance, here’s the model dampened by simply removing the 2% target rate in the equation. What this does is maintain the same proactive approach to Fed policy without the likelihood of overreactions in some environments. This approach would also dampen the efficacy of Fed policy by necessity thereby helping to transition some of the burden to fiscal policy. Not only would it create better balance in Monetary Policy itself by reducing the extreme changes in interest rates, but it would better balance the relationship with fiscal policy by reducing the reliance on all things interest rates….

Source data here.

Update: The Atlanta Fed has started a nice utility page with a bunch of Taylor Rule alternatives that are much closer to me modified TR.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.