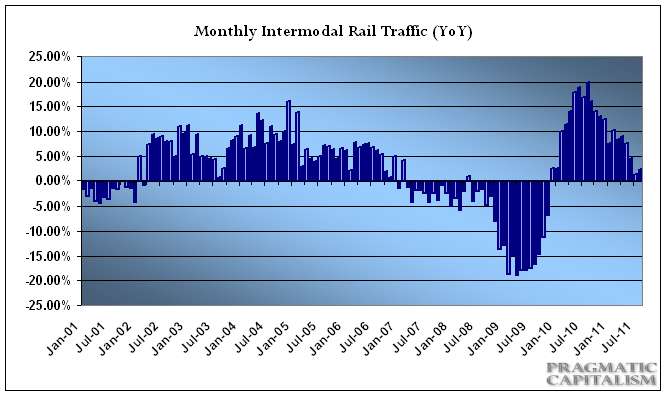

Despite the rollercoaster in the markets over the last two months, rail traffic is still pointing to a moderately healthy economic situation in the USA. The latest Rail Time Indicators report from the AAR showed continued growth in both intermodal traffic and total carloads:

- On a seasonally adjusted basis, total U.S. rail carloads were up 1.1% in September 2011 compared with August 2011 (see the top left chart on page 19). Seasonally adjusted carloads excluding coal were down 0.1% in September 2011 from August 2011. Seasonally adjusted carloads excluding coal and grain were down 0.1% in September 2011 from August 2011. Pages 19 and 20 have more charts covering seasonally adjusted rail traffic.

- U.S. rail intermodal traffic rose for the 22nd straight month in September 2011. U.S. railroads originated 949,606 containers and trailers for the month for an average of 237,402 units per week, up 2.3% from September 2010, up from an average of 235,968 in August 2011, and the highest weekly average for any month since October 2007 (see the chart on the top right of the next page). Week 39 of 2011, the last week of September, had intermodal volume of 250,864 intermodal units, the 12th highest-volume intermodal week ever for U.S. railroads and the highest of any week since Week 39 in September 2007.

- U.S. rail intermodal volume in the third quarter of 2011 was up 1.2% over the third quarter of 2010 (see the chart on the bottom right of page 7).

- Intermodal volume in the first nine months of 2011 totaled 8,881,226 containers and trailers, up 5.4% over the first nine months of 2010. Like carloads, U.S. intermodal volume peaked in 2006 (see the chart on the top left of the next page). U.S. rail intermodal volume in 2011 through the third quarter was 96% of what it was through the third quarter of 2006 (see the chart on the bottom of the next page). Intermodal isn’t quite back to where it once was, but it’s a lot closer to that point than carload traffic is.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.