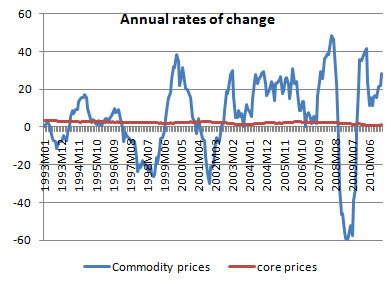

The following is a very good chart from Paul Krugman showing that commodity prices can be very volatile at a time when inflation remains very low. There is obviously no close correlation between core CPI and commodity prices. Of course, this doesn’t mean we should downplay the impact of rising commodity prices. As I described the other day, these price increases are having a very damaging impact on the economy via reallocation of incomes and by reducing corporate margins. But what the commodity price increases do not foreshadow is some horrible bout of hyperinflation. Don’t be fooled by the gyrations in gasoline prices. As 2008 taught us, you never know what might be lurking around the corner. What you see is not necessarily what you get….

Source: NY Times

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.