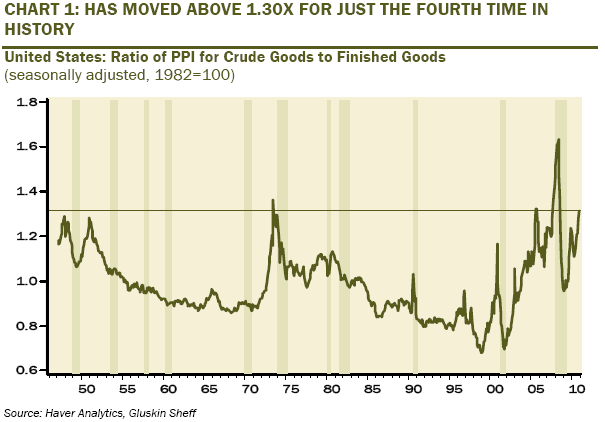

There is, arguably, no negative impact from QE that is worse than margin compression. Not only is this hurting corporate profits, but it is directly contributing to the weak labor market by generating a profit squeeze and a hesitancy for corporate America to boost its single largest cost input – labor. But how unusual is the compression we’re seeing. David Rosenberg notes that this level of compression via PPI has only occurred 4 times in history:

“The fact that we had a broadly based 0.8% run-up in the core PPI for January has investors more convinced that this is good-news pricing power as opposed to the prospect of being an intense margin squeeze for producers. The ratio of producer prices at the crude level of production to prices at the finished gate level just moved above 1.30x for just the fourth time in history. It may pay to note that the first time this happened in the last cycle was in November 2007, when unbeknownst to the majority of market participants, the equity market was in the process of completing what was a very impressive five year 100% rally from the lows.”

Not only is this compressing the consumer balance sheet, but it’s compressing the corporate balance sheet as well. Now, it’s important to note that labor represents a far more significant component of corporate costs. But this likely means the commodity increase will have a relatively limited impact on overall corporate profits, however, it is detracting from the ability of these companies to increase hiring. QE seems to be working like most Fed policy – it’s great for Wall Street and not so great for Main Street.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.