Back in June the ECB initiated a small negative interest rate on deposits held at the ECB. Over the last 5 years we’ve repeatedly heard economists and other pundits say that Central Banks just need to reduce the demand for Excess Reserves by charging a negative interest rate and that this would surely cause inflation to increase as banks would lend out their reserves or “stop sitting” on their money (as Scott Sumner likes to say).

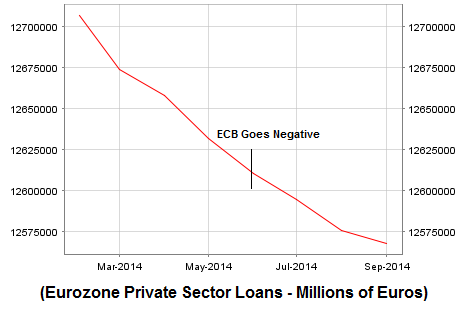

So, we’re almost 6 months into this policy change and what can we conclude thus far? Well, as I stated back in June, this policy wasn’t likely to have much of an impact and in fact, the Eurozone has deteriorated since then. Chart 1 shows the level of bank lending since the beginning of the year. Clearly, the ECB’s negative rate policy isn’t forcing banks to “stop sitting on their money”:

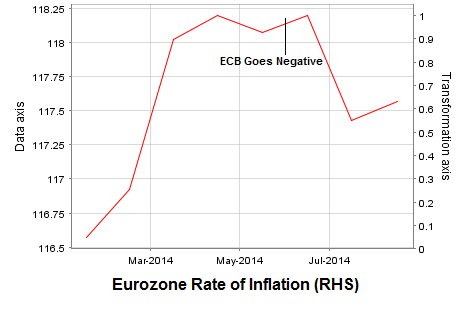

Sumner also claimed that “If they did [charge a penalty] it would be easy to get inflation expectations up to 2%.” But the rate of inflation has continued to decline since then:

Of course, the misguided thinking on this stems from the myth that banks lend their reserves in some money multiplier style fashion or that the Central Bank can control the rate of inflation directly by steering the banks to act in precise ways. But bank lending is primarily a demand side function so supply side economics doesn’t apply to the degree that some economists seem to think. This isn’t rocket science, but very smart people, even after all this time, continue to misunderstand the importance of bank lending and endogenous money….

Thus far, it’s pretty clear that this policy is having no discernible positive impact on either lending or the broader economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.