Negative volatility in long bonds is spiking to unusual levels. As I noted last month and then again recently, this has become a real risk in diversified portfolios because bonds should provide you with protection against permanent loss risk. However, when the deflationary beliefs became almost universally acknowledged in the last few months the long bond zoomed to unreasonable levels. This created the risk that, in the case of higher than expected inflation, long bonds could actually contribute a substantial amount of negative volatility to a portfolio.

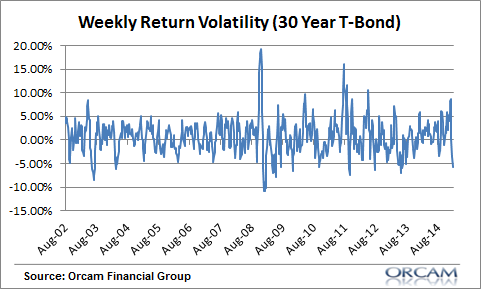

Here’s how this looks in chart form:

With the exception of 2008 & 2013 when long bonds got hammered, this is a pretty unusual level of negative volatility in bonds. I expect this to persist given the depth of the lowflation beliefs. And that continues to present an unusual risk in portfolios where long duration bonds aren’t actually protecting against the risk of permanent loss and instead actually increase the risk of permanent loss.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.