In my book I go into some detail about the equation of exchange (MV = PQ) and why it can be terribly misleading. In essence, the equation is based on totally unrealistic assumptions such as the idea that “money” is some easily discernible item in an economy where financial assets have varying degrees of moneyness. The most basic premise of the equation, the idea that more money necessarily = more inflation, has been thoroughly debunked over the last few decades, but unfortunately, I continue to field a constant barrage of questions about it and how high inflation or hyperinflation are lurking around the corner just waiting for the velocity of money to increase. The problem is, velocity really has no statistically relevant relationship with the rate of inflation.

This whole conversation is a bit strange to begin with because Milton Friedman often assumed that V was relatively constant. Which is bizarre because we know that V wasn’t constant even in the era before Friedman wrote his famous 1969 paper on the “Optimum Quantity of Money”. He also made all sorts of other unrealistic assumptions in the paper such as a fixed money supply, no lending or borrowing and even assumed that people were immortal. He called this a “hypothetical simple society”, but we really should have called it a “totally useless and fake society”. How the paper even left a lasting impression on economists is worthy of debate….

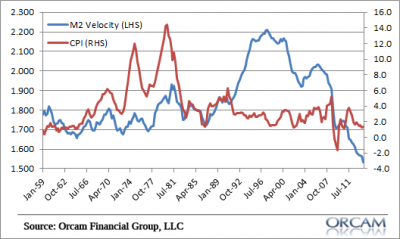

Anyhow, I don’t want to get too deep in the weeds on this, but the idea that higher velocity necessarily leads to higher inflation can be easily debunked by looking at our “realistic complex society”. Over the last 50 years there has been no, I repeat, no statistically significant relationship between the Consumer Price Index and the velocity of M2. In fact, the relationship is virtually negative. If you just eye ball the historical relationship you can see that there is none:

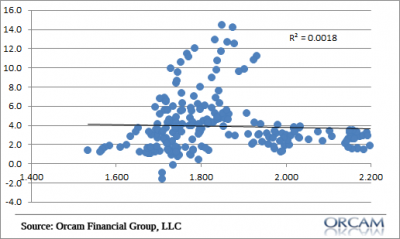

If you actually run the regression analysis you can confirm that there is zero relationship between the rate of inflation and the velocity of money:

So no, there is no reason to believe that higher or lower velocity of money will lead to deflation or inflation. That’s not to say that the equation of exchange is not true. Of course it’s true. But you have to deep dive into the assumptions that its conclusions are based on to actually understand how useful it really is. And when we deep dive into Uncle Milton’s “hypothetical simple society” you find that many of the conclusions are based on a world that resembles nothing like our actual monetary system. And that is why so much of his economics has been proven void of value over the course of the last 30 years – it was based on a textbook world that made the math appear more relevant as opposed to the actual world we live in.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.